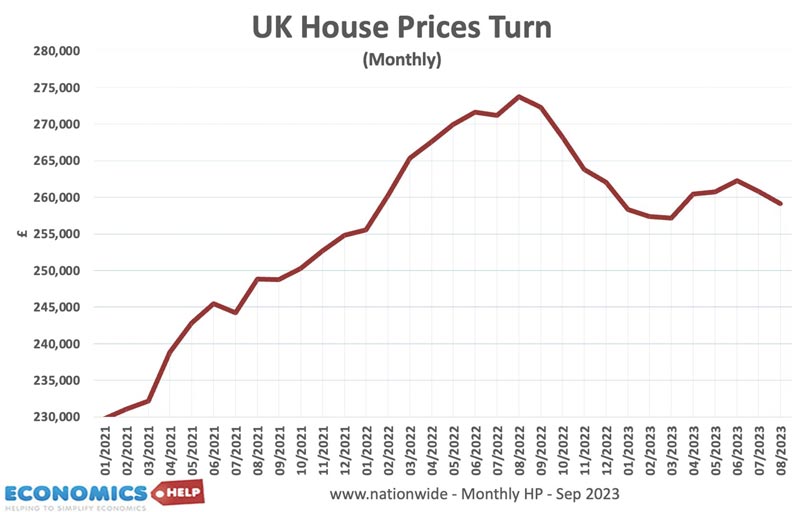

House prices are falling at their fastest rate since 2009. With average prices 5% or £14,600 lower than last year. (Both Halifax and Nationwide reporting similar falls) Whilst Property experts are hoping for a soft landing, the market still has to absorb more bad news with a record fall in mortgage approvals and the impact of higher interest rates making buying less affordable for the foreseeable future.

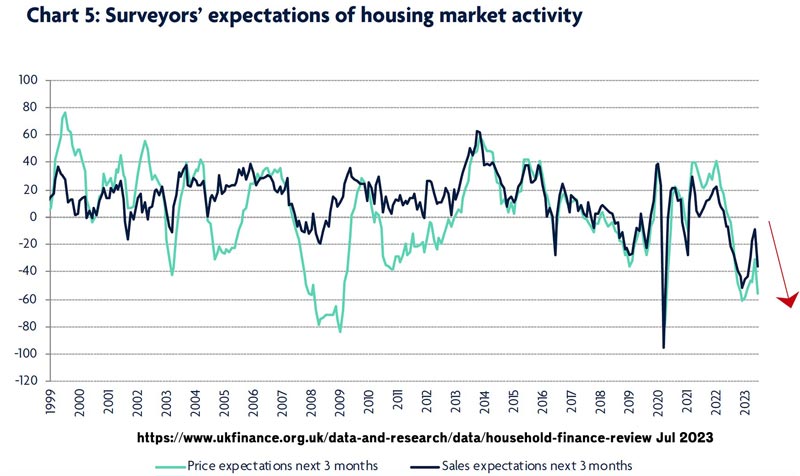

Adjusted for inflation, house prices have dropped 12% in 18 months. And whilst, the ONS house price index is yet to show big falls, its data contains time lags of 6-9 months. Forward-looking indicators such as ssurveyor’s price expectations show growing pessimism regarding house prices as homeowners reluctantly reduce asking prices.

Zoopla is reporting significant fall in demand, and this fall in demand is particularly acute from buyers with mortgages, currently, cash buyers are helping to prop up the market with a 2% rise in demand whilst other buyers dry up. Particularly acute is the decline in buy-to-let investors, who are most affected by rising interest rates and changes in legislation causing many to leave the market.

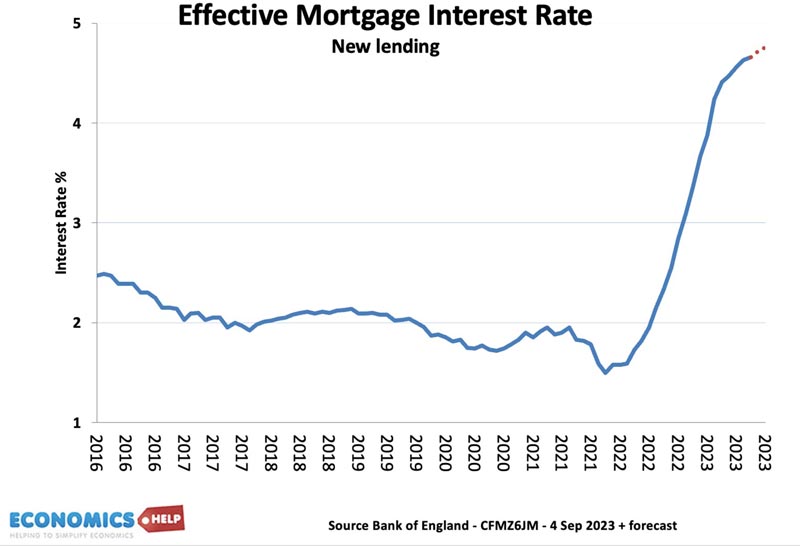

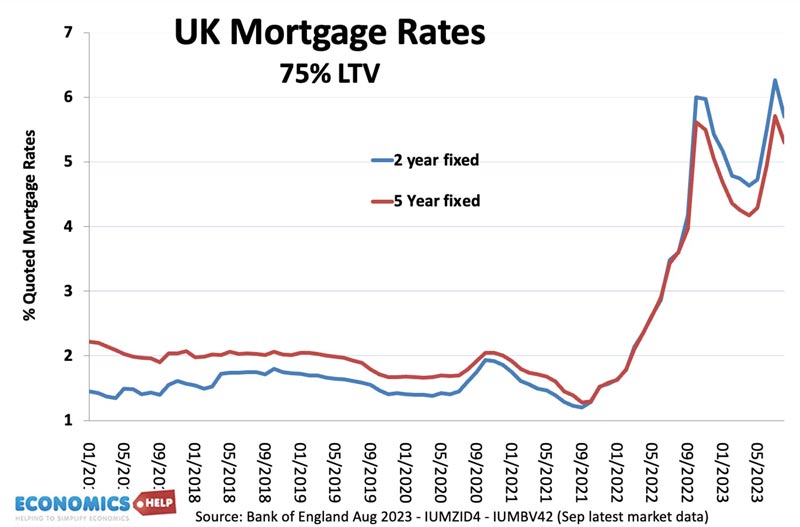

Since the start of 2022, the effective mortgage rate for new lenders has sharply risen fundamentally altering the dynamic of the housing market. The rise in interest rates has created a real shock for a market which has gotten used to 15 years of zero interest rates. As a share of income, we have seen mortgage payments rise to levels not seen since 2007.

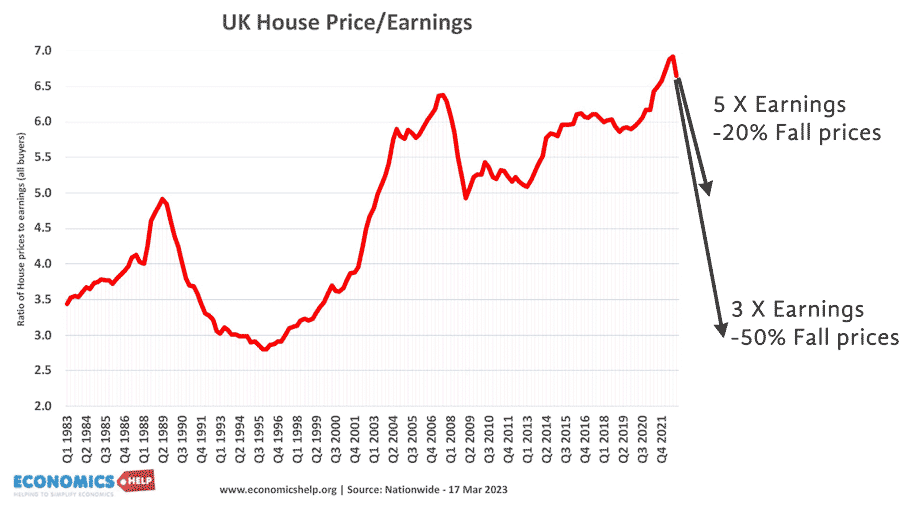

Given record levels of unaffordability in 2022, it is not surprising a doubling of mortgage rates is hitting demand for buying a house.

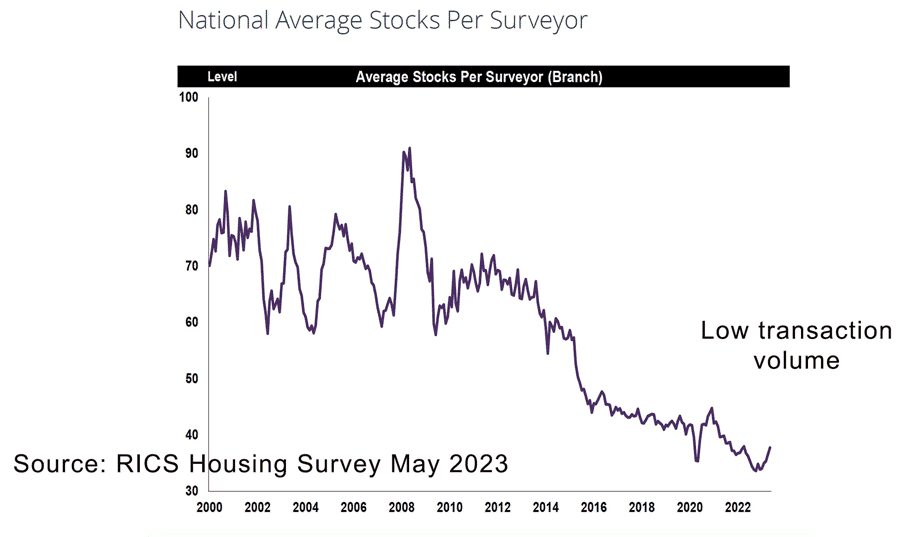

At the moment, the most significant impact on the housing market is a decline in transactions. “Property sales in the year to August 2023 are 341,730 lower than the previous year and 23% lower than 2021 (iNews)

If there is one thing stopping bigger falls, it is the relatively low volume of new houses being put on the market. But, this could change in 2024.

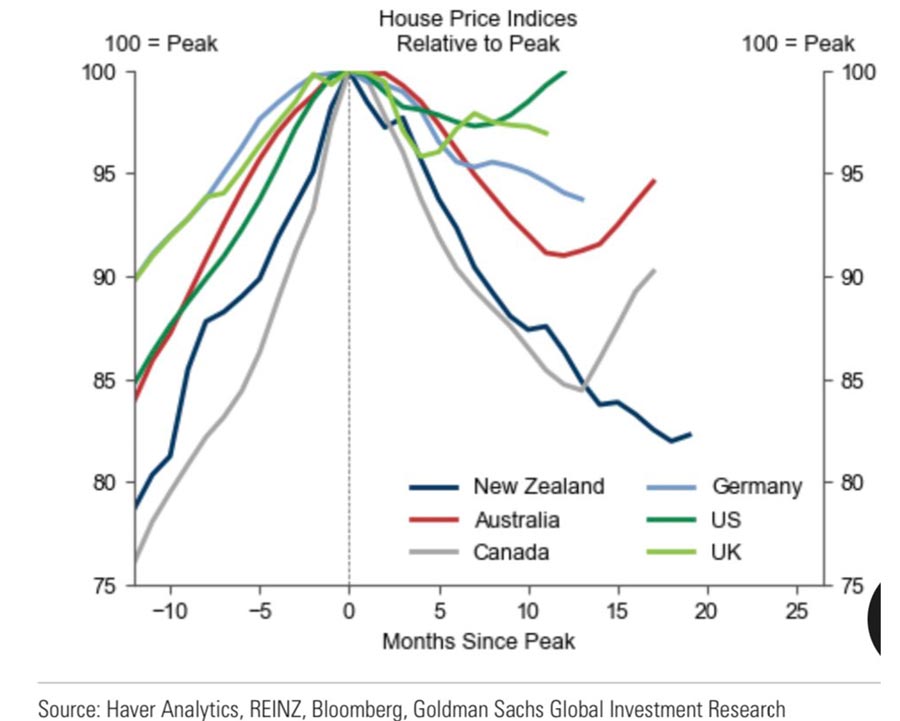

Global House Price Changes

It is interesting to look at global house prices because countries around the world have seen very similar rises in interest rates. Yet, there is a stark contrast between say the US and NZ. In NZ, higher rates have caused a 15% drop in prices. But the US is one of the few places, where house prices are rising. US mortgage rates have soared causing a familiar rise in mortgage payments as a share of income, yet prices have not fallen. The Economist attributes this housing paradox to 30-year government-backed mortgages, which means, those with mortgages at cheap rates are unwilling to move, but stick with what they have. The US has seen a fall in demand for buying, but also a similar fall in the supply of houses for sale. So this paucity of supply is propping up house prices as rents continue to rise and the economy does better than expected. But, how long this will last is another matter. Whereas in NZ, the property bubble has popped and there has been a significant fall.

If there is a fall in demand, but a shortage of properties, we tend to get a fall in transactions but modest price falls. But, if we get a fall in demand, plus a rise in supply, that is a recipe for a big drop in prices. The UK doesn’t have a glut of excess homes, like say Ireland or Spain in 2007 (where prices dropped 50% – a very real crash) But, at the same time, home builders are complaining about the difficulty of selling new homes, and if this continues they will be forced to cut asking prices.

The UK is also different to the US, in that there are very few 30-year mortgages, most homeowners are on short-term mortgage deals, which means more will remortgage to higher rates.

What could stop prices from falling?

Cuts in mortgage rates. Since the mortgage panic earlier in the year, lenders have started to cut mortgage rates from the previous highs of July. This fall in mortgage rates will help potential buyers. However, it is misleading to think of mortgage rate cuts, because even with these declines, mortgage rates are still over double the level of two years ago. The bigger picture is the rate rises are a little less damaging. Also, there are millions of homeowners who still face remortgaging at a much higher rate in the coming months. 200,000 homeowners will be remortgaging in Jan 2024 alone. As more face higher rates, it will reduce spending in the economy and may force a small minority to sell.

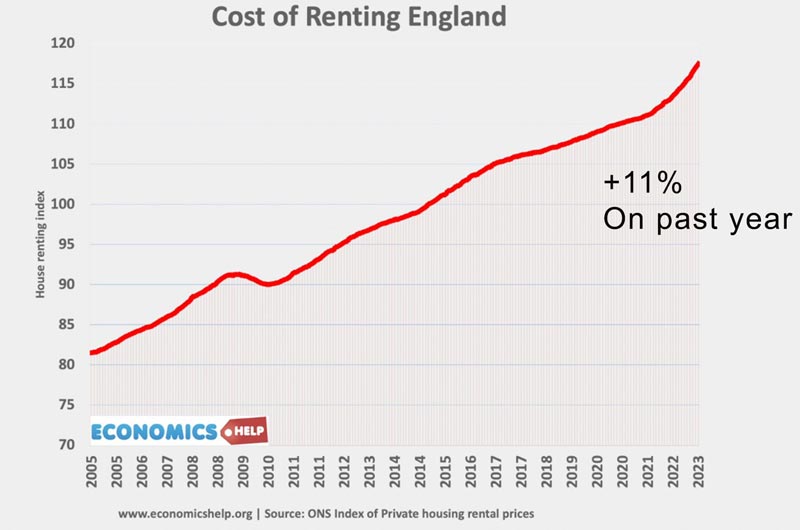

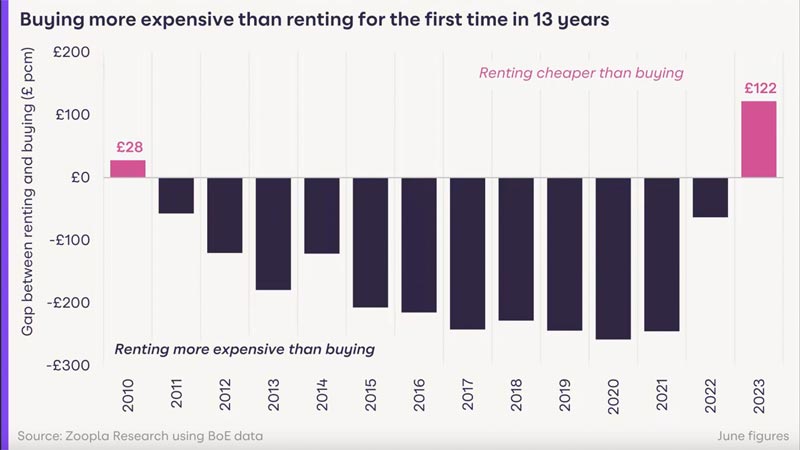

Rising rents. A shortage of properties combined with a sharp rise in demand is pushing up rental prices. People in the rental sector are desperate to escape the rented sector. However, the desire to escape the renting sector is not the same as the ability to leave renting and buy. According to Zoopla the rise in mortgage rates has meant that buying a house is more expensive than renting for the first time in 13 years.

Therefore, rising rents alone are not enough to prevent house price falls.

Government support. Falling house prices deeply affect the British psyche, it can guarantee to make front-page news and is often seen – perhaps wrongly as a barometer for economic status. In past years, the market was helped or you could say inflated by a stamp duty holiday, help to buy, QE and funding for lending. This contributed to some of the past house price rises, especially during the covid period. But now it has been withdrawn it is negatively affecting the market with homebuilders particularly bemoaning the loss of help to buy. The problem is that these interventions are expensive and generally wasteful, and why should the government prop up house prices and try to maintain historically high levels of unaffordability? Anything is possible in an election year, but it would be a fool’s errand to try and buck the market pressures through expensive and wasteful intervention, especially when renters are facing even more financial pressures.

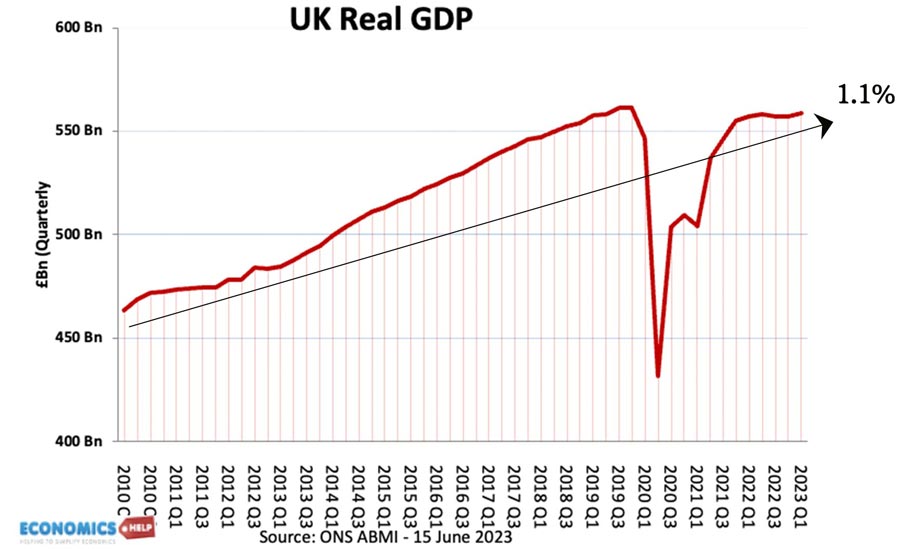

An improving economy? The fall in demand is not just coming from rising interest rates, but also a weak economy and cost of living pressures. Record inflation and falling real wages have eaten into COVID-era savings and made it harder to save for a deposit. Unfortunately, there is little good news on this horizon. The UK economy is still facing the effect of the past 14 interest rate rises, There can be a time lag of up to 18 months, so well into 2024, the economy will be slowed by previous rate rises. Recent data such as the Purchase Manager Index all point towards a decline in economic activity.

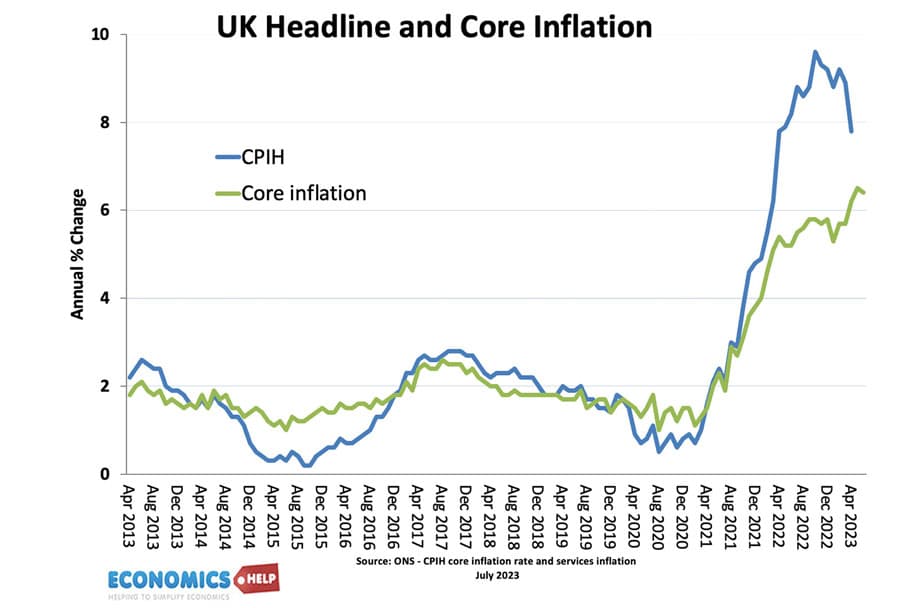

Rapid fall in inflation and base rates. The key thing that would stop house prices falling, is a sharp drop in inflation and core inflation. Whilst a slowing economy will eventually bring inflation down, there is less optimism on inflation than at the start of the year. Core inflation has been more persistent than hoped and Oil prices have recently risen again. The increased risk of geo-political and climate-related shocks means the previous decades of ultra-low inflation looks less likely with cost-push inflation pressures an increased risk. After missing inflation in 2022, the Bank of England is keen to restore its credibility, and there is a willingness to stick with higher interest rates – even if it causes significant costs in the economy and housing market in particular. Fewer people live in houses paid for buy a mortgage than in the past. This means to reduce inflation, there will be a bigger impact on mortgage holders and hence the housing market than in the past.

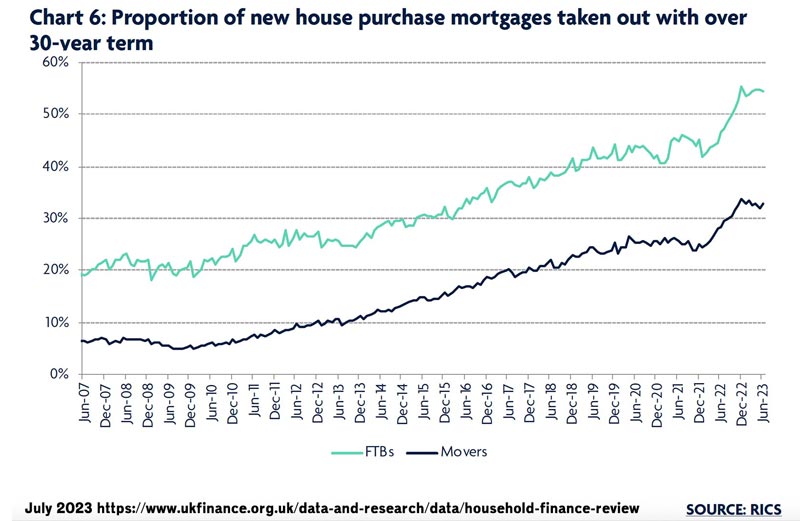

Extension to mortgage term. One way buyers have dealt with the rise in mortgage rates is to extend mortgage terms. There has been a growth in the average mortgage term, but there is a limit to how much this can deal with the market. The number of FTB mortgages over 30 years rose from 20% in 2007 to 55% in 2022 but has dropped in recent months. If you’re in your 40s and are contemplating a 30-year mortgage, that means you will paying into your 70s.

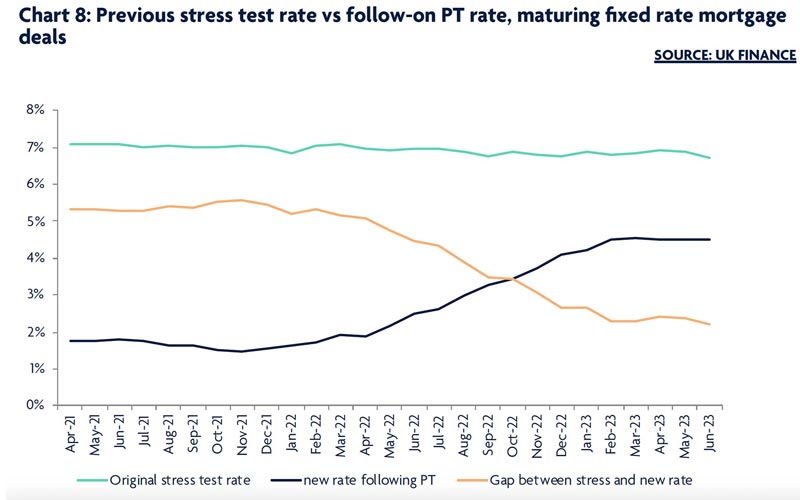

The one good piece of news for the UK is that unlike in 1992 and 2007, many existing homeowners were stress tested at higher mortgage rates, The gap between actual rates and stress test rates is falling, but we do not see the same degree of reckless mortgage lending such as the build up to the credit crunch. However, in 2008, interest rates were cut to 0.5%, reducing the impact of the last housing crash. That is unlikely for the foreseeable future. Arrears are much lower than in the early 1990s. But, even a small rise would have a big impact. The National Institute of Economic and Social Research (Niesr) reports that 50,000 moved into negative equity, and if the price keeps dropping more will fall into this category.

Rising wages. Last month, the UK saw a very strong growth in nominal wage growth and for the first time in months, wage growth was higher than inflation. This increases nominal buying power and will help limit the fall in nominal house prices. However, the rise in wages is not sufficient to counter the impact of higher mortgage rates and despite the rise in nominal wages, workers are not feeling better off.

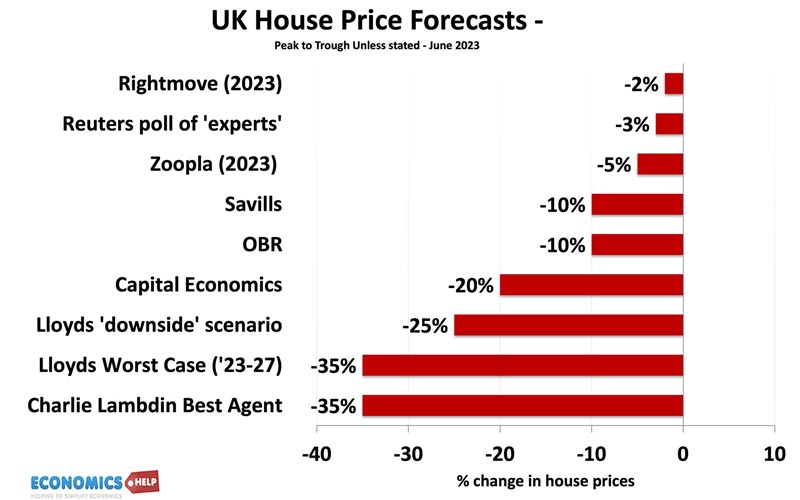

Predictions for house prices range enormously from modest falls, all the way to big falls of 35% from peak to trough. Overall the factors that have caused the initial price falls, still have some way to go. Although the UK economy has defied predictions of recession this year, there is an accumulation of negative pressures which will affect the economy next year. The housing market is