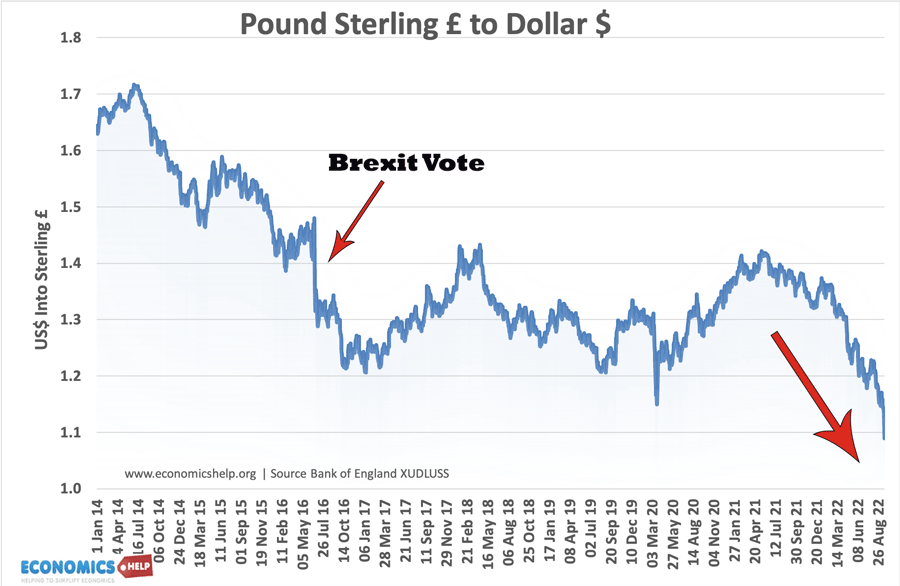

In recent weeks, the Pound Sterling has fallen – losing value against the dollar and other currencies. This year, the Pound has fallen over 16% against the dollar and 7% on a trade-weighted index.

In Summary A falling Pound makes:

- UK imports become more expensive and UK exports more competitive.

- A falling Pound tends to cause higher inflation, but could cause a boost to short-term economic growth through higher exports.

- A falling Pound might improve the current account as it boosts exports relative to imports

- However, a falling Pound may be indicative of a very weak economy that markets are pessimistic about.

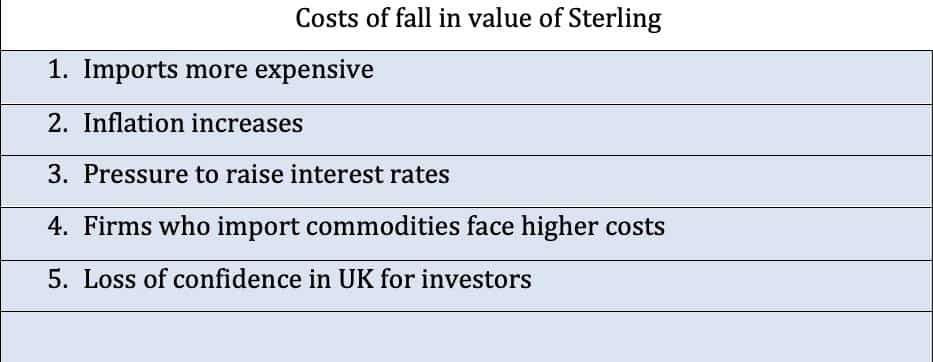

Costs of fall in Pound

1. More expensive Imports

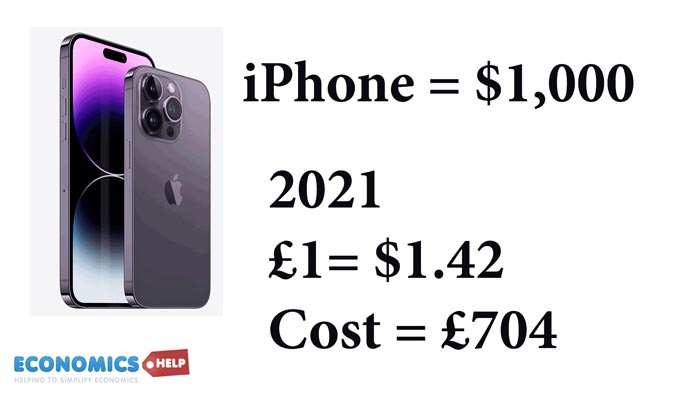

As the value of Sterling falls, UK consumers need to use more Pound Sterling to buy the same amount of foreign goods. Let us use an example of an imported iPhone.

As of yesterday, the Pound had fallen 24% to £1 = $1.08. The cost of buying the same iPhone has now risen to £926. An increase of £222 (or 31%).

Clearly, this kind of decline in the value of the Pound is going to have a big impact on consumers, leaving less disposable income to buy other goods (though it may benefit local producers who become relatively more competitive. But, for many goods like iPhone, oil imports consumers don’t have any domestic options and it is difficult to substitute.

2. Higher oil prices

Because the UK is a net importer of oil and gas, a fall in the value of sterling has a big impact on the price of petrol and diesel. Oil and gas tend to be priced in $US so as the Pound falls (especially against the dollar), the price of petrol will rise as a result. This explains why US petrol prices have fallen nearly back to the pre-crisis level, whereas UK prices are much higher. The AA notes that if the Pound had kept its level of £1 to $1.35, petrol would be at least 11p cheaper or £6 a tank cheaper.

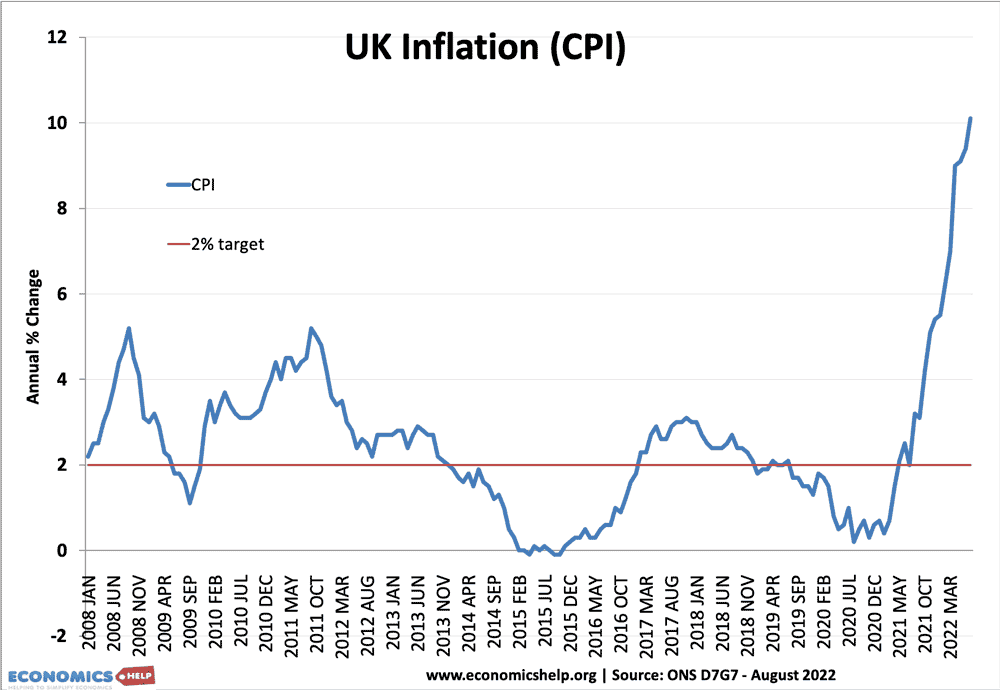

3. Cost-push inflation

Rising prices of imports contribute toward cost-push inflation. In 2008 and 2012, the spikes in inflation were also partly due to a weaker Pound, but they were temporary. The prolonged weakness of the Pound in 2021 and 2022 is causing a more serious rise in inflation (also of course, caused by rising oil prices), This rise in inflation can also cause higher inflation expectations and knock-on effects, e.g. price rises become embedded and put upward pressure on nominal wages. The rapid depreciation we are seeing is worsening the inflationary effect, and this can cause a negative spiral as rising inflation itself puts more downward pressure on Sterling.

4. Pressure to raise interest rates

If there is strong downward pressure on Sterling and the Bank of England feels this is becoming destabilising, they will increase interest rates to protect the value of Sterling (making it more attractive to save in UK). However, rising rates will increase UK debt interest rate costs, UK mortgages and loan rates, all causing downward pressure on demand. In this case, the Bank is raising interest rates because markets are concerned the recent budget is exacerbating inflation and causing an unsustainable rise in debt. But, it is probably raising interest rates reluctantly because of their impact on household finances.

Benefits of falling Sterling

- More competitive exports As the Pound falls in value, it is good news for exporters, who will become more competitive in international markets. For example, whiskey firms who rely on export market to North America will be able to make bigger profit margins and/or undercut rivals to increase market share.

- Potential boost to domestic demand. A depreciation in currency encourages domestic consumption rather than imports and increases export demand. This can lead to a boost in economic growth. For example, in 1992, when the UK Pound was overvalued, leaving the ERM and the subsequent devaluation led to a strong economic recovery as export growth increased. (It was also helped by lower interest rates). However, in Sep 2022, this is unlikely to happen, any boost to growth from higher exports will be countered by rising inflation and rising interest rates.

- Can help to reduce the trade deficit. A large trade deficit implies there is an imbalance of exports and imports, a depreciation can help reduce this as it makes domestic goods relatively more competitive.

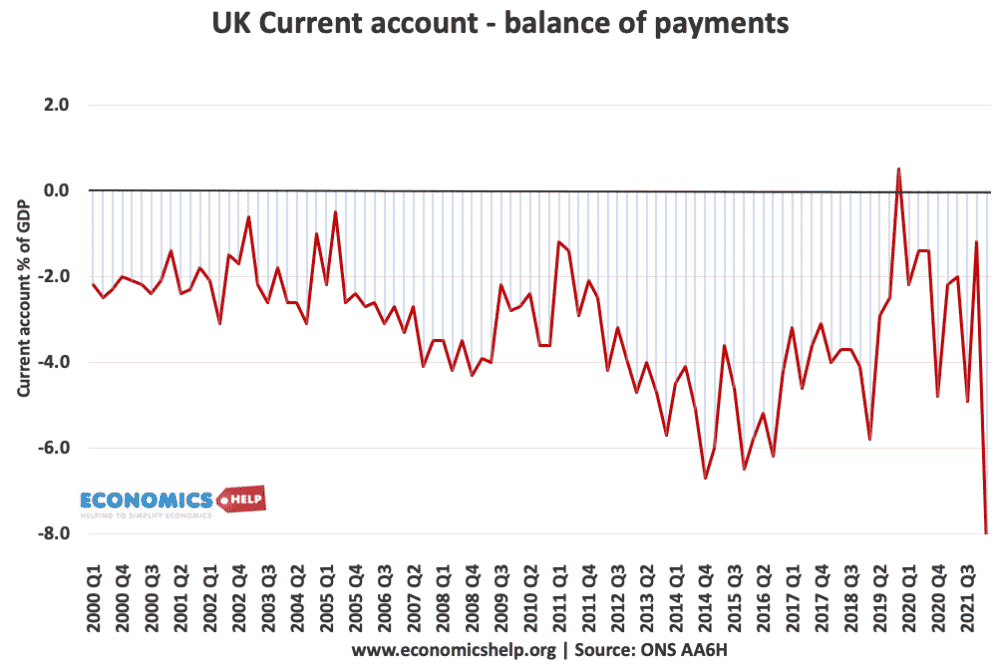

In 2022, the UK has a large current account deficit and a fall in the exchange rate will go some way to improve the current account.

However, in recent years, demand for exports and imports has proved quite inelastic and a fall in currency has often done little to improve the trade deficit. For example, the current account deficit has worsened in 2021 and 2022 – despite a weaker Pound.

For example, depreciation makes gas imports more expensive, but there is no alternative so as the price rises, the UK has to spend more on imports. The value of gas imports is predicted to rise from £1.8bn to £8bn this winter because of rising prices. This will actually worsen the current account, highlighting the importance of elasticity of demand to the effects of devaluation.

Long term effects

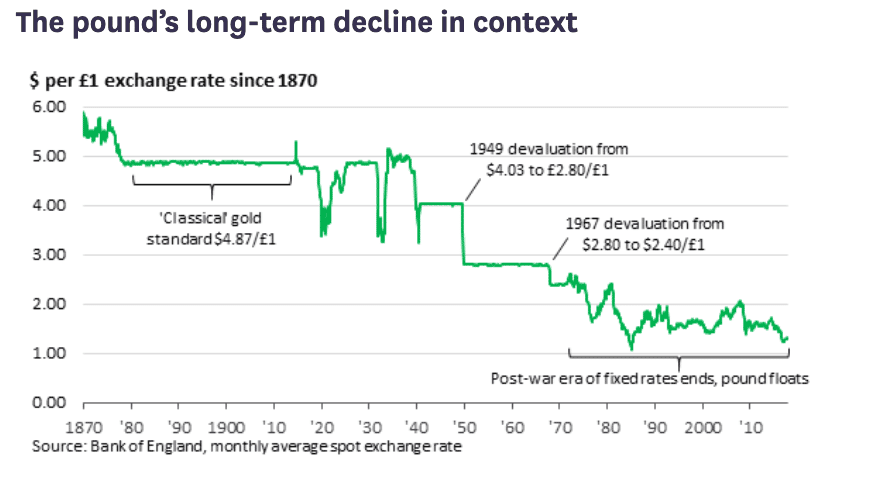

A short-term effect of a weaker Pound is that exporters get a boost in competitiveness, but how long does this improved competitiveness last?

This shows the fall in the value of the Pound since the last century. It reflects the UK’s declining competitiveness and pre-eminence in global economics. It reflects the fact that the long-term decline in Sterling reflects the long-term decline in relative competitiveness. A weaker Pound can give a short-term boost, but a strong economy will see an appreciation in the exchange rate.

Also, a fall in the Pound may give a temporary boost to competitiveness but often causes inflationary pressure. It is not just from more expensive imports, but exporters may face less incentive to cut costs when they can rely on a weaker currency. This was the logic for fixed exchange rates – arguably it would increase the incentive to be competitive and not rely on the easy option of depreciation.

Why is there a fall in the value of the Pound

It is also very important to know why the Pound is falling. For example, when the UK left the gold standard in 1931, it helped the economy recover from Great Depression. When the Pound left the ERM in 1992, it led to a long period of rising growth in the great moderation. You could say these were ‘good’ devaluations because they moved Pound to a more competitive rate and avoided the need for high-interest rates and tight monetary policy.

The depreciation in the Pound we see in 2022 is very different, it reflects the fact that markets are concerned about

- Inflation rising in the economy due to cost-push factors and tax cuts of mini budget

- Government borrowing is set on an unsustainable path due to unfunded tax cuts.

Further reading