Readers Question: What does the Government spend its money on?

The government spends money for a variety of reasons:

- Reduce inequality (welfare payments like unemployment benefit).

- Provide public goods (fire, police, national defence)

- Provide important public services like education and health (merit goods)

- Debt interest payments.

- Transport

- Military spending

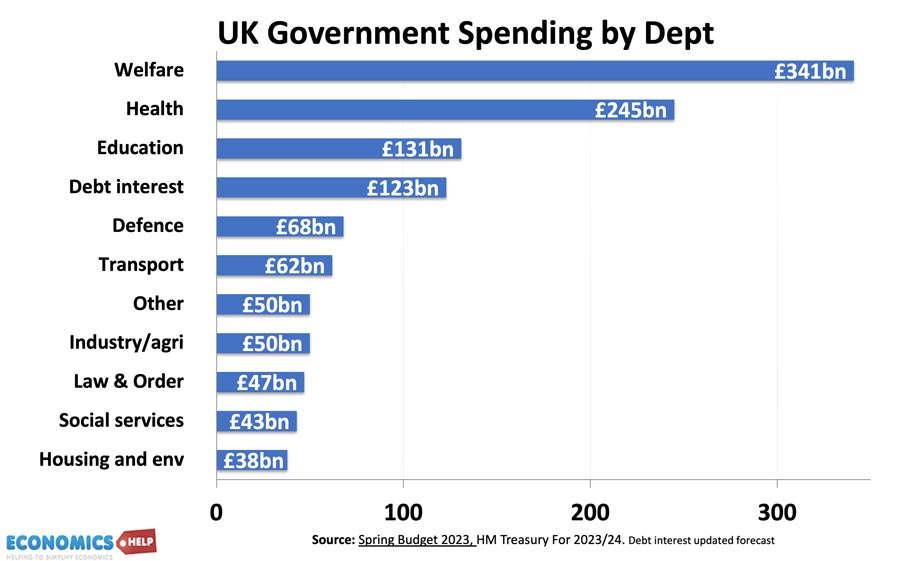

UK public sector spending 2023-24

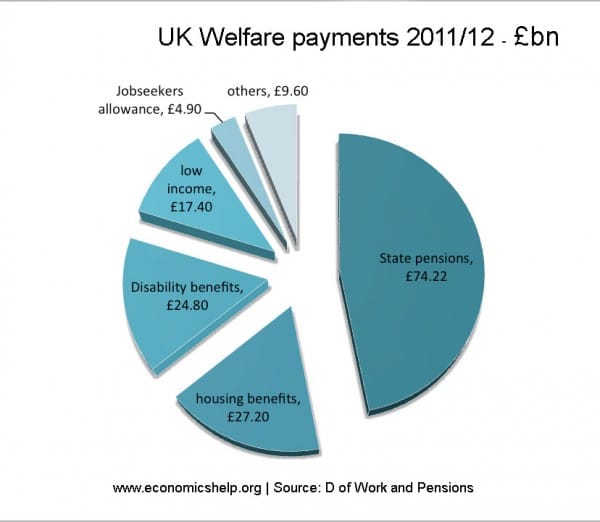

In the UK, the biggest department for public money is social security. This takes almost a quarter of all public spending. It goes on financing a variety of benefits (State pensions, public sector pensions, housing benefits, income support, disability/incapacity benefits, unemployment benefits).

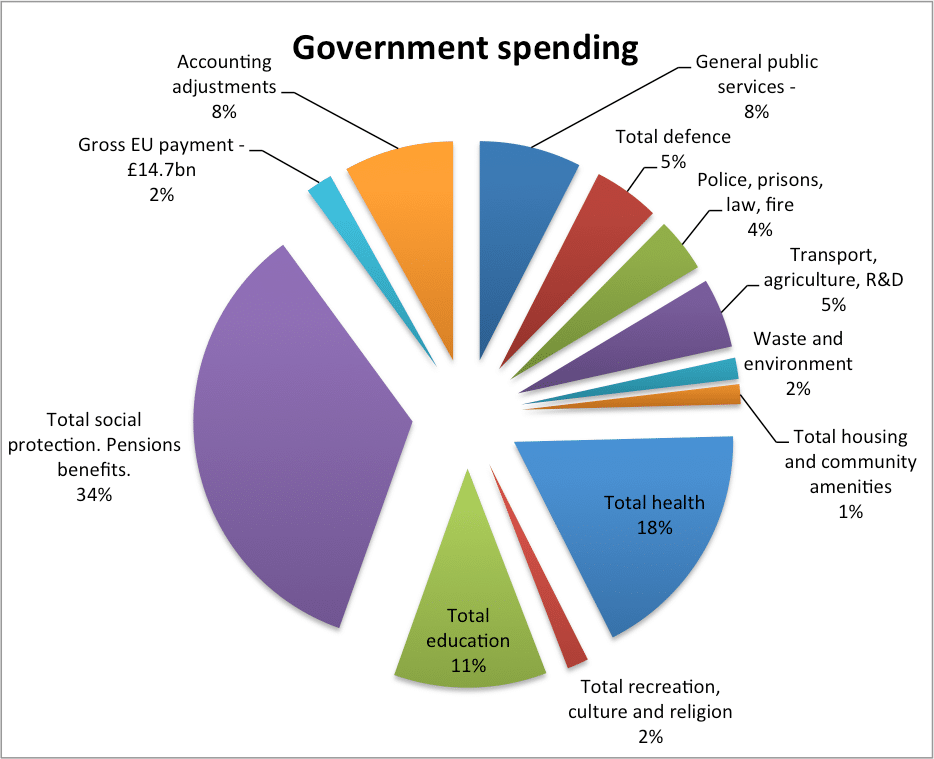

EU spending is £14.7bn (2014). Net spending £9.9bn. See more at the cost of EU

See also: Public Spending at UK Gov

Main areas of Government Spending 2015

- Public Pensions £150 billion

- Sickness and disability £40bn

- Old age pensions £107bn

- National Health Care + £133 billion

- State Education + £90 billion

- Secondary education – £25bn

- University education – £11bn

- local education spending – £48bn

- Defence + £46 billion

- Social Security + £110 billion

- State Protection + £30 billion

- Transport + £20 billion

- Railway – £5.2bn

- Roads – £3bn

- Local transport – £9bn

- General Government + £14 billion

- Executive and legislative – £5.9bn

- Other Public Services + £86 billion

- Social housing – £1.2bn

- Waste management – £9bn

- Public Sector Interest + £52 billion

Cost of EU

- Gross payment to EU – £17.2bn

- Net payment to EU – £8.6bn

- FT – EU cost

Total Spending = £731 billion

- Source: UK Public Spending

Other Notes

- Foreign Aid £7.8 billion or 0.7% of GDP 2011/12 (Cost of Foreign aid)

- Job Seekers allowance £4.9bn (or 0.7% of total spending) 2013/14

The largest area of government spending?

By far the largest area of government spending is social protection. £222bn (2015) 34% of government spending. However, this budget can be split up into different compartments. The biggest single item of government spending is public pensions, with NHS spending in 2nd place.

What percentage of UK spending is on the EU?

If you take gross payments (ignoring EU payments to the UK), in 2014 – £14.7 billion was transferred from the UK to the EU in official payments. This is 2% of government spending.

If you take the £7.1bn net contribution, it works out at 0.9% of public sector spending or £110 per person per year. It is 0.4% of GDP.

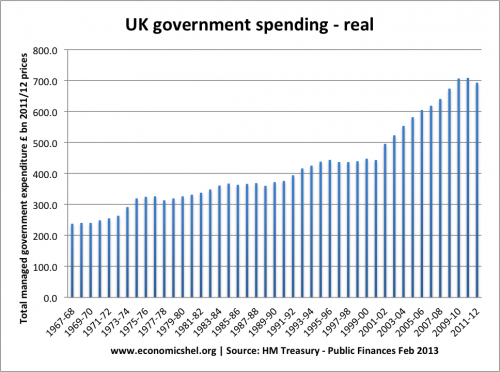

Total Government Spending

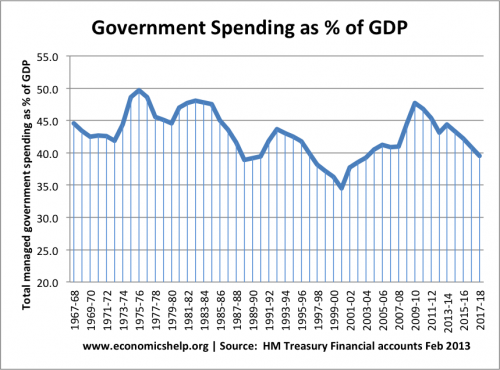

Government Spending as % of GDP

In 2010, the government embarked on tough spending cuts to try and reduce the budget deficit. However, spending on debt interest payments rose to £48bn. Also, spending on welfare benefits rose because of the increase in unemployment. Overall the government plan to keep spending static in real terms (adjusted for inflation)

See also: Total UK government spending

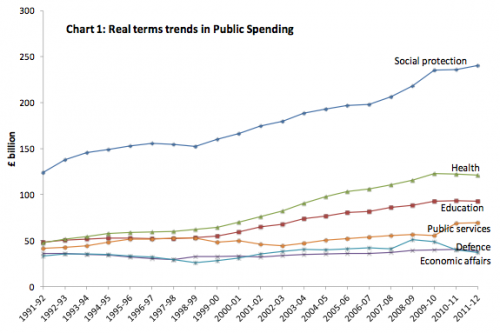

Changes in UK government spending

source: HM Treasury

In the past 20 years, in real terms, the biggest increase in government spending has been in the area of health care.

Welfare Payments

Welfare benefits (billion, bn)

- Housing benefit £16.94 bn

- Disability allowance £12.57 bn

- pensions credit +MIG £8.11 bn

- Income support £6.92 bn

- Rent rebates £5.45 bn

- Attendance allowance £5.30bn

- Incapacity £5.30 bn

- Jobseekers allowance £4.90 bn(0.7% of total spending)

- Council tax benefit £4.80 bn

- employment + Support £3.58bn

- Sick + maternity pay £2.55 bn

- Social fund £2.37 bn

- carers allowance £1.73 bn

- financial assistance £1.24 bn

- See more on UK social security payments

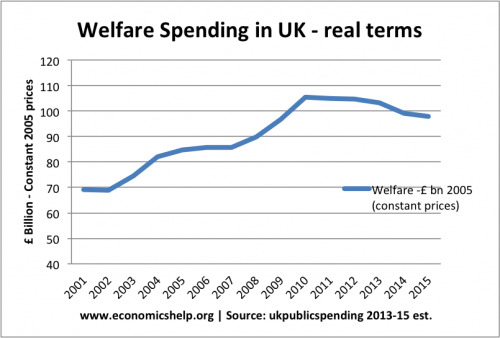

The welfare budget includes spending on unemployment, income support (universal credit), housing benefit and disability allowances. It increased to £105bn in 2011-12

As a percentage of GDP, welfare spending is just over 7% of GDP.

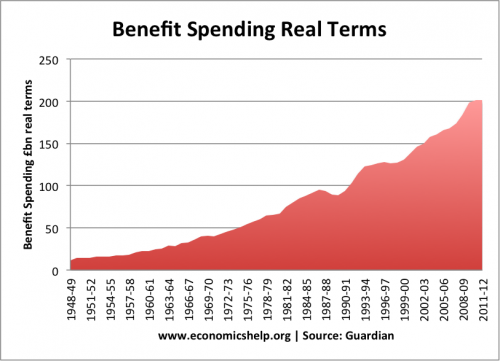

Total Benefit Spending

Total benefit spending includes the welfare budget, plus also the total spending on pensions. The total benefits bill for the UK was £200bn in 2012. See growing size of welfare state

What checks the use of the UK’s public money. Starts with a ‘p’ , three leters altogether.

the goverment makes money from taxes,healthcare,education and welfare

What’s the most important thing that the goverment spends money on in the UK and the thing they should cut spending on if they don’t have enough money. Please reply soon as it is for homework

Nice try George Osborne, we know it’s you really.

What checks the use of the UK’s public money. Starts with P and has 3 letters altogether?! Looks as if Aidan and I are doing the same crossword!!

your website could give more informatio about spending money 🙂 x

hey guys was just wondering how much david cameron is going to cut from us working middle class guys

I’ve got an assigment and got to write what the goverment spend on the Vat and Income tax money that they get please help ?

I’ve got an assigment and got to write what the goverment spend its money that they get please help ?

Thanks for this very useful website and for the information on the UK National Debt and Government spending.

I would also find it helpful if there were information on Government Income – Corporation Tax, Income Tax, VAT, Excise Duties etc, just to complete the picture.

Cheers.

Yes,a pie chart laying out percentages of income from corporation tax, income tax, vat, excise duty’s etc.. would be very good.

Also a pie chart showing percentages of income by sector, banking, retail, I.T., export… would also be good.

Tax sources https://www.economicshelp.org/blog/4001/economics/tax-revenue-sources-in-uk/

i think goverment should spend money on sport facilities for young people as would keep them from commiting crime. in addtion it is beneficial for health

Stop beliveing the stereotypes. We don’t commit crimes every day. Our to do list does not consist of be a pain, terrise a shop by standinbg outside it and rob another shop! Plus, it’s businesses that spend money on that not the goverment