Readers Question: What is the relationship/theory between the OCR (Official Cash Rate) and Inflation?

The Official Cash Rate is the interest rate the New Zealand Reserve Bank use to control inflation. It is very similar to the base rate used by the MPC, Bank of England.

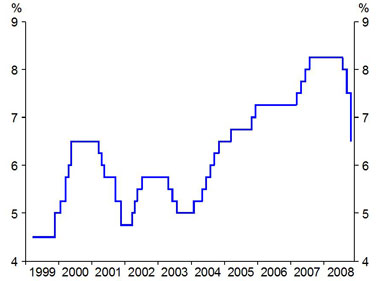

Graph Interest Rates New Zealand

Because New Zealand commercial banks borrow from the reserve bank, this official cash rate influences all interest rates in the economy.

The Reserve bank will increase interest rates (tightening of monetary policy) to reduce inflationary pressure.

Higher interest rates:

- increase cost of borrowing

- increase incentive to save

- reduce disposable income of people with variable mortgages

This reduces consumer spending, investment and therefore aggregate demand growth; this helps reduce inflation.

At the moment, the New Zealand Reserve bank is cutting interest rates (like Central banks around the world) because of the global slowdown. WIth inflation falling, the Reserve bank are cutting rates to try and prevent recession.

Generally lower inflation enables lower interest rates. Higher inflation leads to higher rates.

However, sometimes, Reserve banks will increase interest rates in anticipation of inflation.

Or at the moment, the Bank of England is cutting rates aggressively in anticipation of lower inflation next year.

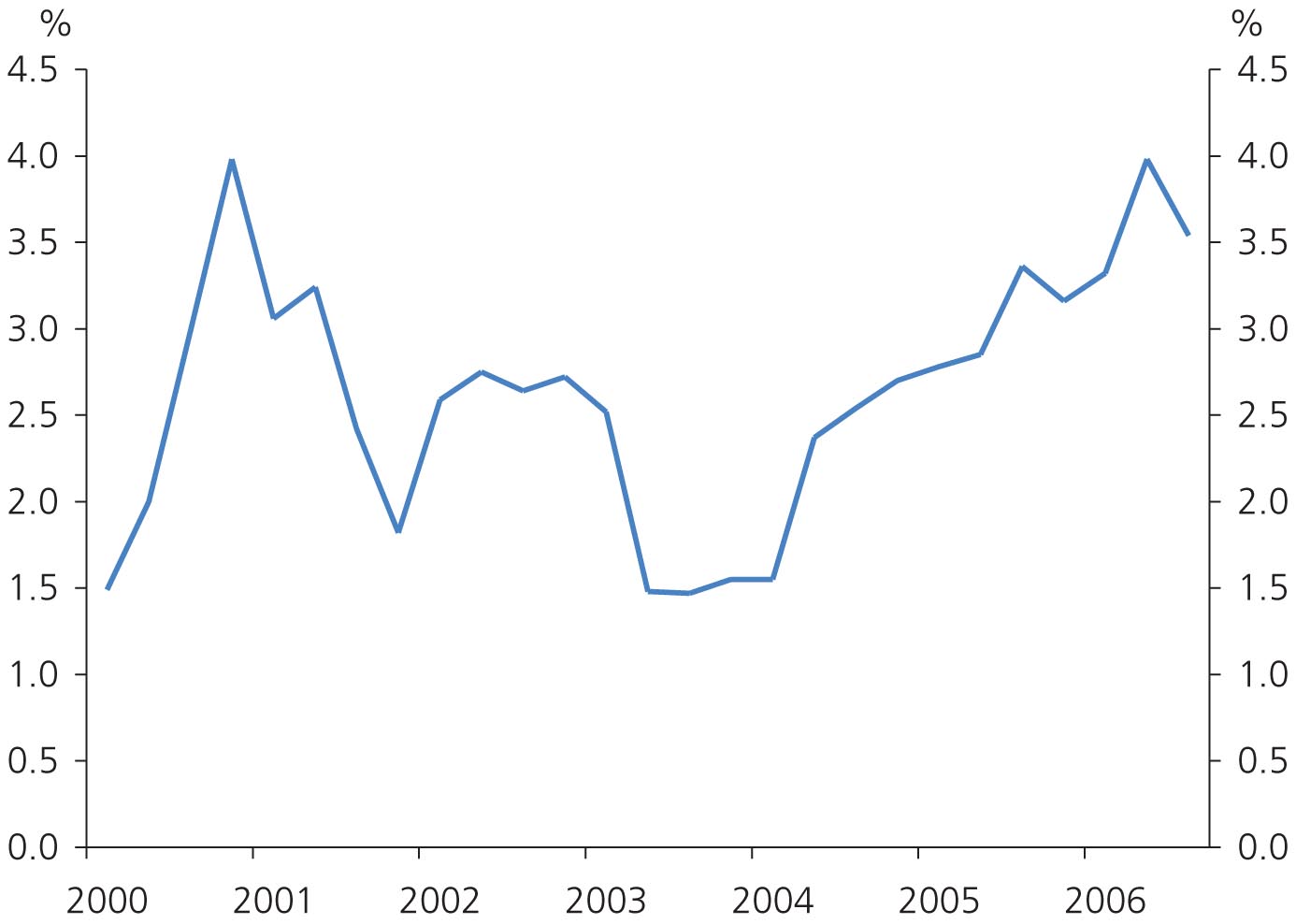

Graph inflation NZ

Forecasts for NZ Inflation and Interest rates

With end in cost push inflation and the global slowdown spreading, the NZ economy is likely to have lower inflation and lower interest rates in 2009

see also: Monetary policy in UK

this helped heaps in determining the link between domestic financial markets and their euromarket equivalents!

hi im pravesh…..i wntd 2 kn da relationship btwen interest rates n the TWI.n also relationship btwn inflation n the ocr…..its 4 m assignment,……thnkz….