Inflation, in the UK, is calculated through measuring changes in the cost of living. The official method is the CPI – Consumer Price Index. CPI Measures the annual % change in price level.

Steps for Calculating Inflation

- Firstly, the government (through ONS) undertake the Family Expenditure Survey (FES). The FES is a voluntary survey of about 6,000 people. This finds out what % of income is spent on different goods. Basket of Goods at ONS.

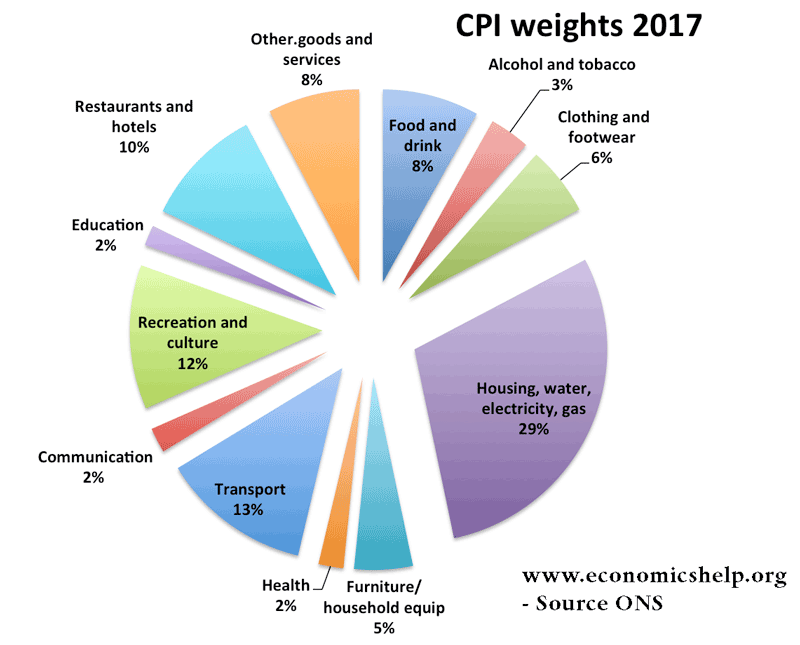

- This enables the government to create a typical basket of goods. From this a weighting is given to the different goods. e.g petrol may account for 8% of spending. Cigarettes 6% e.t.c The weighting reflects the relative importance of the good to people’s spending.

UK Basket of Goods

source: ONS

- The weighting of main sectors in the UK Basket of Goods.

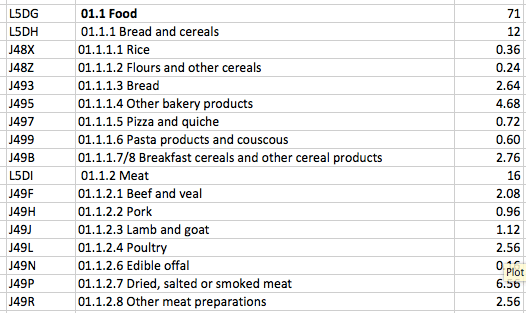

- Each section is then sub-divided into different groups – for example food – Rice, Bread e.t.c.

- Then the government undertake a price survey. This means checking the prices of the 1,000 most common goods in the UK, every month. The % change in the price of individual goods and services are noted

- The price increases are then multiplied by the weighting of the goods. e.g. if petrol increases 10% and has a weighting of 1.3% in the basket it will be 10% * 0.013

- This means they can then calculate the price index. The index is a way of measuring % changes. A base year is chosen, which starts the price index.

Example of calculating inflation

Related

what are methods used to measure inflation

The example of calculating inflation table only works because all the goods and services were the same price in 1999 (I.e.100). I don’t see why the example table doesn’t follow the explanation in the previous paragraphs. An extra column showing the percentage increase from 1999 to 2000 (100%, 20%, 0% and 50%) which applying the weightings of 0.1, 0.25, 0.25, 0.4 becomes 10%, 5%, 0% and 20% which sums to 35%.