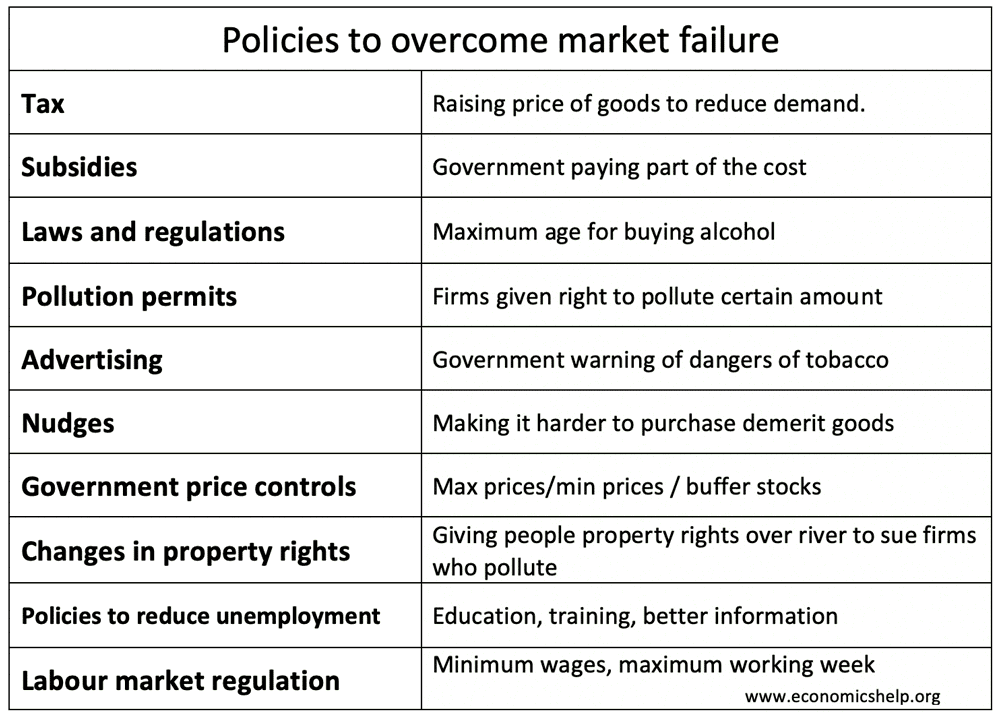

To overcome market failure, the government can use various policies. For example, to reduce consumption of demerit goods, they can increase taxes.

Policies to overcome market failure

- Taxes on negative externalities

- Subsidies on positive externalities

- Laws and Regulations

- Electronic Road Pricing – a specific tax related to congestion

- Pollution Permits – giving firms the ability to trade pollution permits.

- Advertising: Government campaigns to change people’s preferences.

- Nudges – use of behavioural economics

- Government price controls – Max and min prices Buffer stock schemes – Government price control to try to stabilise prices.

- Changes in Property Rights – Coase theorem

- Policies to overcome poverty/inequality – inequality can be seen as type of market failure

- Policies to reduce unemployment – policies to overcome market failures, such as geographical and occupational immobilities.

- Labour market regulation – Minimum wages to deal with monopsony power

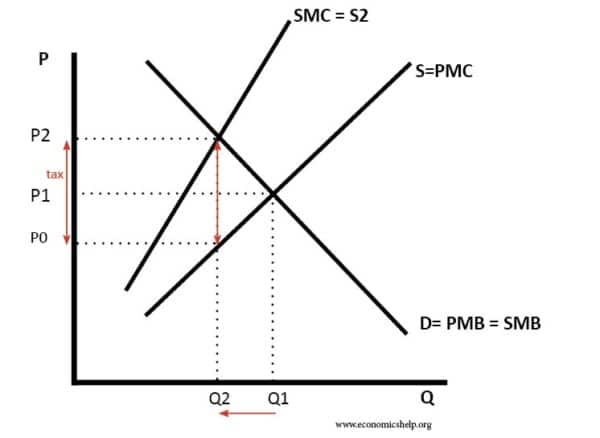

Tax

A tax shifts supply to the left and raises the price of the good.

Types of taxes to overcome market failure

- Airline tax

- Carbon Tax

- Cigarette Tax

- Death Tax

- Fat Tax

- Income tax

- Petrol tax

- Plastic bag

- Poll Tax

- Rubbish tax

- Tobin Tax

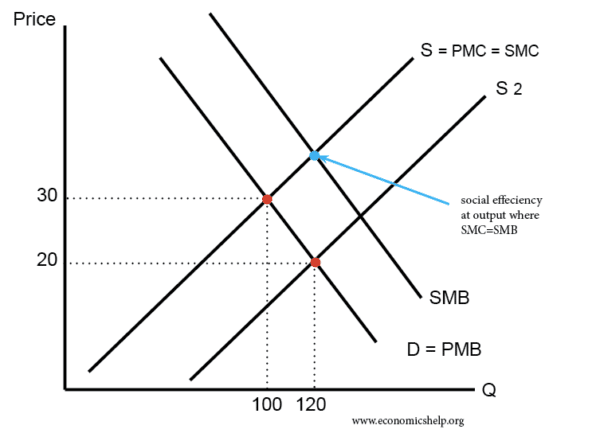

Subsidies

Subsidy shifts supply to the right and moves the equilibrium closer to where SMB = SMC.

- Farming subsidies – is there a case for extra subsidies for farmers?

- Subsidies for positive externalities

Government price controls

Labour market regulations

Related

- Government failure – when government efforts to reduce market failure lead to an inefficient outcome.