Rubbish piled up on the streets was one of the most evocative images of the 1970s. But the winter of discontent is back with Birmingham city council struggling to stave off bankruptcy. But, it’s not just Birmingham, the national audit office argue that a cumulative deficit of £4.6 bn could cause 43% of authorities to be at risk of bankruptcy – it is a legacy of austerity, growing demand for social care, special needs education, equal pay claims and inadequate means of local tax collection. And it’s not just deprived areas, Woking, Croydon, Hampshire leafy suburbs with bankrupt councils. There are some solutions, but the backlog will be hard to fix.

Equal Pay

Birmingham declared bankruptcy in 2023, citing a £760m bill for equal pay as a key reason. The 1970 equal pay act meant firms could no longer pay women lower pay for doing exactly the same job as men, like at the Dagenham Ford factory. But, from the 1980s, this evolved into equal value, which means if jobs are judged to be of equal value, the pay must be the same. What this means is that if predominantly male refuse collectors are judged to be of similar value to predominantly female cleaning or admin jobs, then it is illegal to pay refuse collectors more. UK litigation which encourages no win, no fee, has led to an industry of lawsuits focused on equal value, and it is local councils who have been left nursing huge bills. Birmingham City Council has already paid out £1bn. It is currently trying to remove the fourth worker on a refuse lorry to limit future equal value payments. It’s not just about paying bin men, it’s about the knock-on claims to other jobs, which are rather arbitarily considered to be the same as a refuse collector. This is particularly affecting left-wing councils who prefer to keep direct employment in the council. One way to avoid equal pay claims is to outsource work to other companies. Though this is more expensive and has its own drawbacks

Austerity

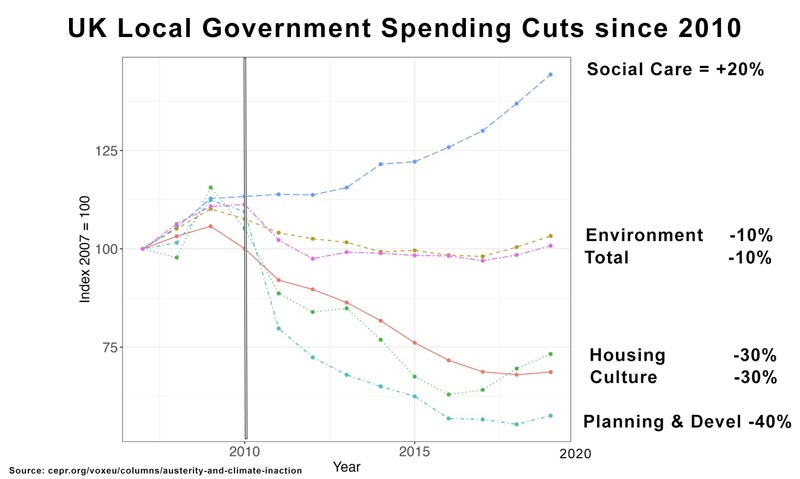

But, whilst this is a factor, arguably the biggest elephant in the room is austerity since 2010. It was local authorities who saw the biggest cuts to budget departments under the coalition government. Between 2010 and 2019, the real value of central government grants fell 40%. The shortfall was supposed to be made up by local taxes and new sources of funding. But, local authorities are capped in their ability to raise taxes. Council tax is quite a regressive tax taking a bigger share from low income households. And the Central government limit how much council tax can rise. In a desperate bid to raise money some local councils such as Croydon borrowed £543 million to invest in property development business, but oversight was feeble and the council is yet to make returns whilst paying millions on debt interest. The result is that even with a wider range of charges such as higher car parking fees, and new charges for using council services, the core spending power of local authorities has been cut by 25% since 2010. There has been some uptick in spending since 2015, but, given rise in population,n funding per person is still lower.

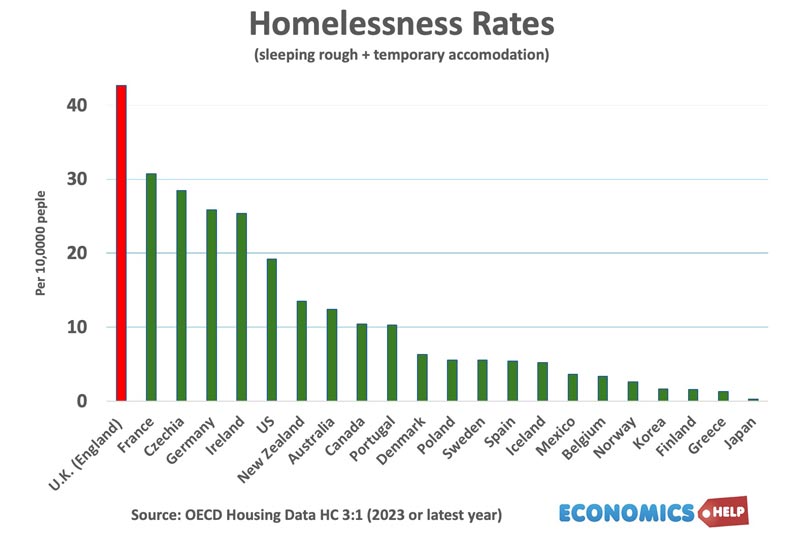

Homelessness

Another reason for council overspend is rise in homelessness which leads to legal requirements to spend more on temporary accommodation, such as hotels and B and B’s. Including temporary accommodation, the UK has one of highest rates of homelessness, a reflection of the very high rental costs. Local councils have been given targets for homebuilding. But, often struggle to build. This is due partly to strong local NIMBY pressures, but also they argue increasing the housing stock and population, isn’t particularly financially attractive as it leads to higher demand for council services, without corresponding increase in funding. One solution is to give councils more financial benefit from increasing the local housing stock. In the long term, it would be cheaper than paying for hotels and housing benefit.

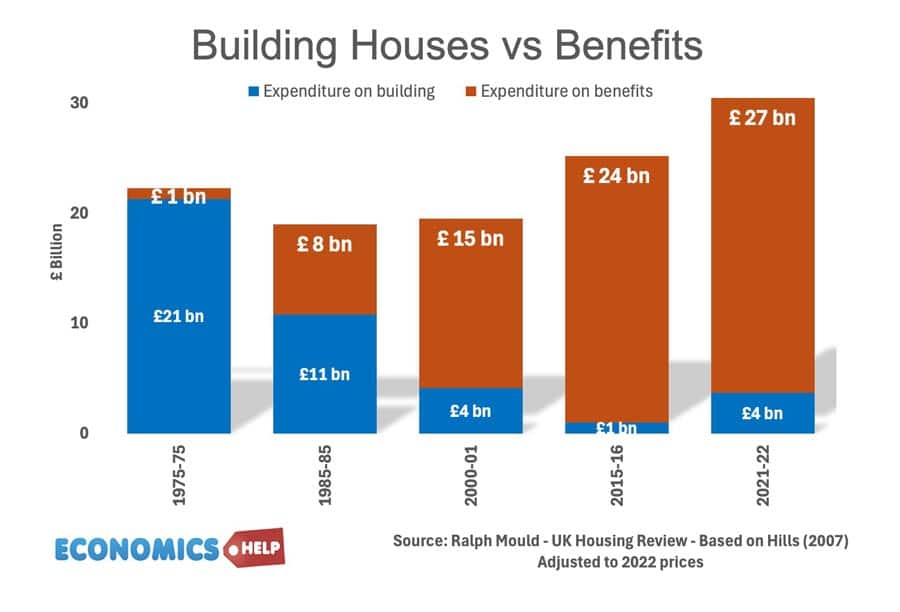

This graph shows how the UK used to spend more on building housing than benefits, but in recent decades, this has been reversed. It is symbolic of a failed approach to housing. It is worth mentioning one positive development of past decade has been giving councils 50% of business rate collection, which gives more incentive for councils to encourage business to set up.

Social Care

But, whilst real funding per person has fallen, statutory spending has increased. The biggest causes of higher demand is social care. Local authorities have legal requirement to provide both adult and children’s social care. Here demand has increased significantly in recent years, because of an ageing population, and declining health, particularly exacerbated during the covid era. Social care is clearly an important function of the welfare state, but unlike health or pensions, provision is left to local authorities who have very limited ability to raise finance compared to central government. The result is that councils are spending an ever higher share of their spending on these statutory requirements, causing other areas like libraries and refuse collection to be slashed to the bone. For many years, the central government have ducked from providing a comprehensive solution to social care, preferring to kick the can down the road. The problem is that with the population share over 65 set to rise, this area of spending will only grew in future years.

Special Needs Education

Another area of higher statutory spending is related to special needs education. The Children’s and Families Act 2014 mandated that children with special education needs receive the best education. But, there has been a higher than expected growth in the number of children with these requirements and an increased expense. Yet, with a familiar story – funding has not keeping up. The local authorities association claim a funding gap of £600m, much of which has been kept off the books by an accounting trick. When this expires next year, council budgets will appear to be even worse than they are now.

Problem

From 2010, The UK decided that local authorities should be responsible for meeting the needs of really important and growing areas of public spending, whilst at the same time cutting their funding, reducing expenditure and generating new sources of income. You don’t need to be an accountant to work out that this is a recipe for disaster, especially because many areas of local spending have needed to increase faster than expected, notably special needs education and social care. On top of this, some councils have been whacked by huge backdated claims of equal pay decisions. It means that councils have performed poorly in perhaps one of the most pressing needs of local economy providing more affordable housing. In constantly dealing with short-term cash crises, there is no room for the long-term investment in social housing, which local authorities used to be able to afford. So what are the solutions? Real regional devolution means councils may need more tax raising power, or at least more financial interest in allowing housing and property development. One thing is councils shouldn’t be forced into trying novel and untried financial strategies to fix budget black holes through commercial investment, they are not skilled in. But, any fix will need to address social care, with a long-term, sustainable model. It is worth pointing out, that in 2017, the Conservative government proposed using part of the wealth from home ownership to fund social care. Labelled a dementia tax, it was very unpopular and caused Theresa May to nearly lose election, but it was at least an effort to make use of the UK’s high level of wealth to deal with an issue that will only see growing demand in the coming years.

Related

Sources:

- https://www.walesonline.co.uk/news/wales-news/council-spending-3500-week-accommodation-31477071

- www.economist.com/leaders/2025/04/16/the-lesson-of-birminghams-striking-binmen

- https://www.economist.com/britain/2025/04/16/birminghams-bin-strikes-reveal-local-problems-and-a-national-one

- https://www.theguardian.com/society/2025/feb/28/almost-half-of-englands-councils-could-face-bankruptcy-over-deficit

- https://www.itv.com/news/central/2025-02-04/bankrupt-birmingham-confirms-148m-of-council-cuts-in-second-budget-blow

- https://www.independent.co.uk/news/uk/politics/birmingham-city-council-bankrupt-equal-pay-deal-b2661807.html