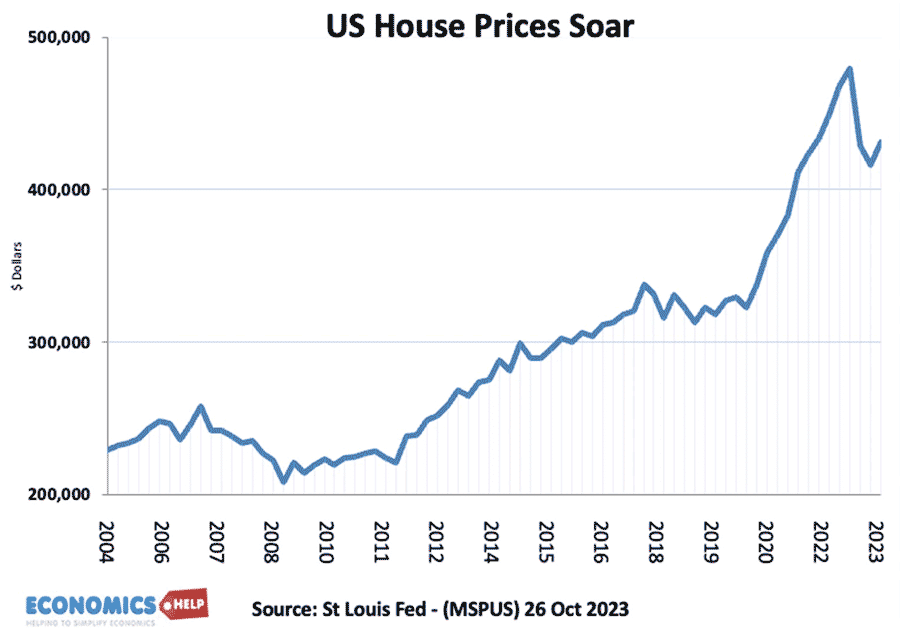

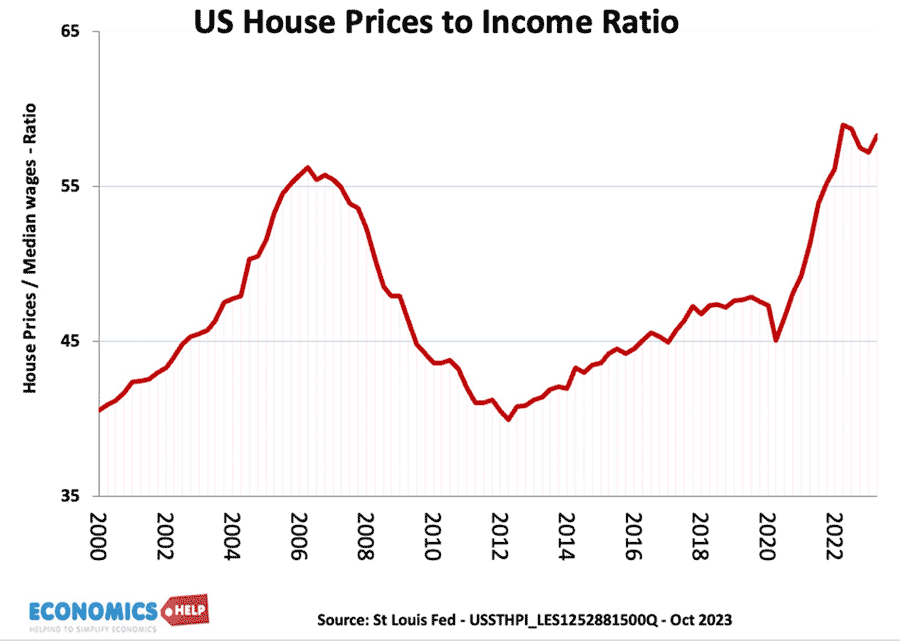

In recent months, the US Housing Market has seen record house prices, mortgage rates quadrupling from 2 to 8%, and price to income multiples worse than 2006. It is a familiar story across the world. But, so far US house prices have seemed to defy gravity. Yet how long can they remain so elevated?

Will 2024 finally be the year where we see a major housing correction with a huge impact on the rest of the global economy?

In the aftermath of the devastating credit crunch, the US housing market boomed, and this boom became a runaway train during the Covid pandemic. A combination of ultra-low interest rates, pandemic stimulus and a shift to working from home caused demand and prices to soar. At the start of the pandemic, a $60,000 income was sufficient to buy a typical home, but in the space of three years, this had soared to $114,000 – an income far higher than average incomes, pushing homeownership out of reach for a new generation of Americans. And the ratio of house prices to income has soared to a level last seen in the credit crunch.

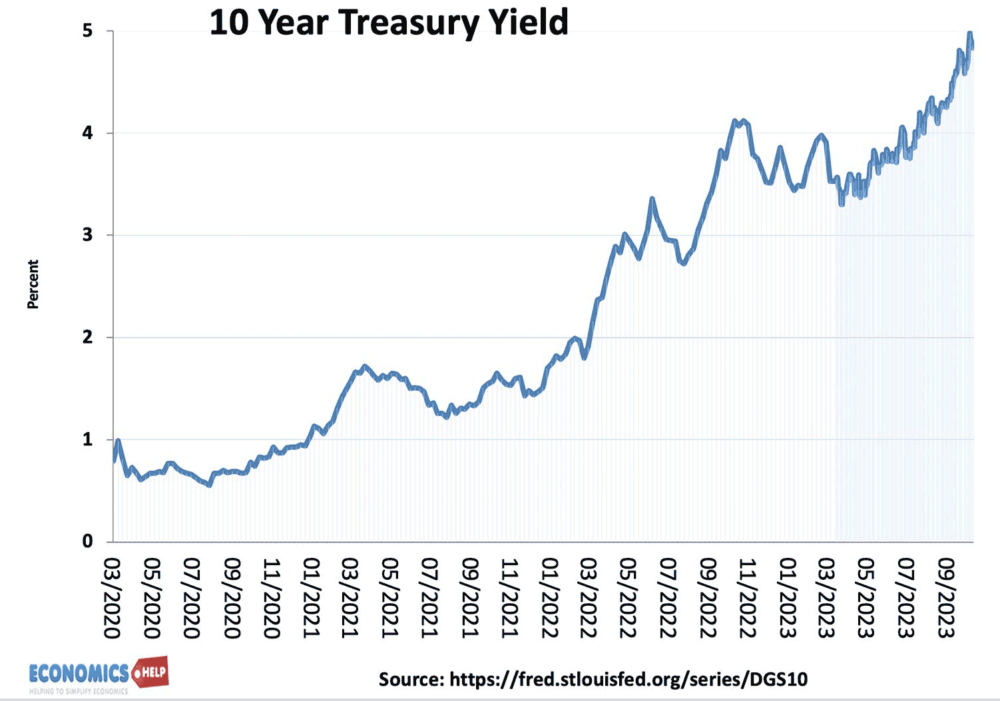

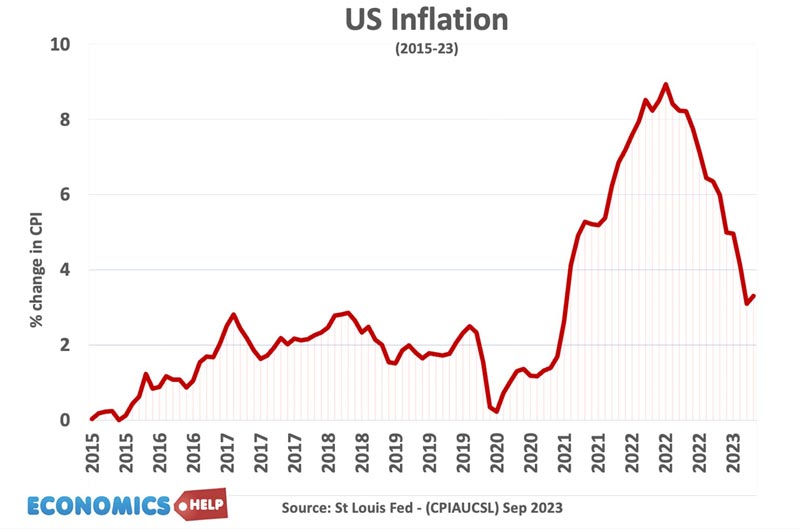

However, unexpectedly high inflation caused the Fed to increase interest rates, and with strong recent economic growth mortgage rates have risen even faster as markets predict higher rates for the long term Recently the mortgage rate on a 30-year fixed rose to 8% – the highest level since 2000. Back in 2006, a modest rise in interest rates to 5% was enough to precipitate a housing crash, with the devastating international repercussions.

The rise in market interest rates is very significant. US bond yields have risen to their highest level since 2001, and this is changing the dynamics of investment. The Cap Rate is effective the return an investor can get from buying a house and renting it out. Despite rising rents, Cap rates have fallen (to around 4.5%) because the surge in house prices has been even greater. This year bond yields exceeded that of the CAP rate for the first time in decades. It means an investor can get a better rate of return from buying a safe asset like US bonds rather than riskier investments like buying a house, with considerable effort and time. So far the market has not yet reacted to this.

Falling Mortgage Demand

Mortgage demand has fallen to a near 30 year low. 22% lower than the same week one year ago. The impact of higher rates will have a delayed effect on the economy and housing market next year.

Why Prices Have Remained Elevated

There are clear ingredients for a fall in house prices. Prices are overvalued, new buyers can’t afford them, and the interest rate cost has soared. Yet, in the last quarter, US house prices rose, suggesting quite a strange market. There are five factor which can explain this rise but the big question is will it last or will 2024 be the time the market finally breaks?

30 Year Fixed Mortgages

Firstly, it is a different scenario to 2006. Since the credit crunch, most US mortgages are 30-year fixed. It means many recent buyers remain unaffected by rising rates. The actual amount of income, American households are paying in mortgage payments is at low levels. 82% of homeowners in the US have a mortgage rate under 5%. Now, that will change over time as new buyers get substantially higher payments, but it is very different to 2006, when homeowners immediately saw the impact of higher rates.

Shortage of Supply

Secondly, American homebuilders are more cautious than 2006, the boom in demand in Covid, did not lead to a boom in building. The decline in homebuilding has also been exacerbated by the rising cost of construction. Inflation has seen a near-doubling of the cost of building houses. This has led to a shortage of housing, squeezing prices higher. According to Realtor.com analysis, there was a shortage of about 2.3m homes by the end of 2022, an increase of about 500,000 since 2012.

Shortage of homes for sale. Thirdly, the shortage of homes for sale, is exacerbated by the interest rate rise. Many recent buyers can keep their ultra low 30 year mortgage deal as long as they stay where they are. The costs of moving are prohibitive and so the market has become kind of stuck and stagnant. With very few properties on the market, it only takes a small amount of demand, to keep prices high.

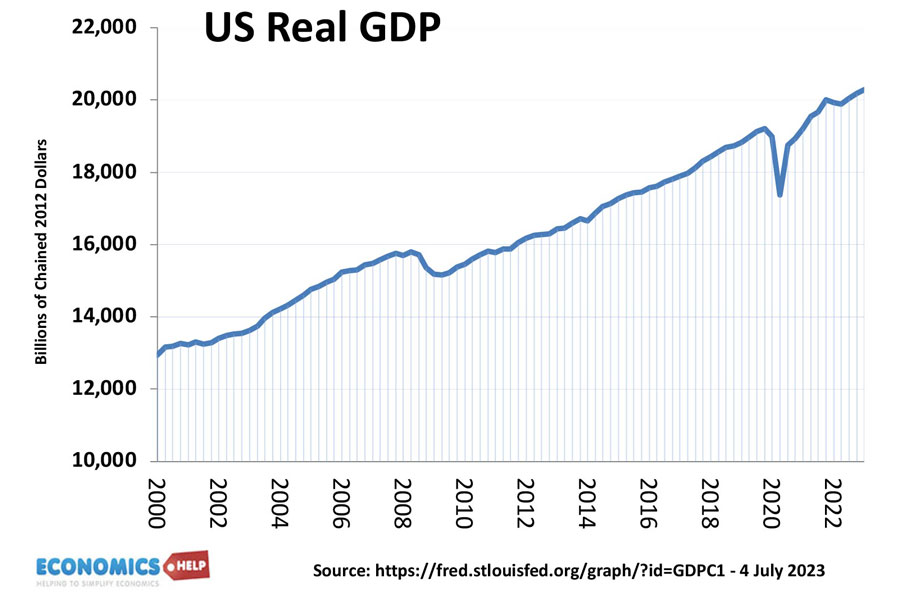

US economy Fourthly, the US economy has been doing well. The US has achieved a remarkable recovery from the pandemic stimulus and not only has the US avoided recession, but posted remarkable economic growth – much faster than say the UK. This has propped up demand for housing as wages rise. Also, if we look at real house price growth the picture is less spectacular. At least part of the Covid-boom in house prices was inflationary.

Robert Shiller the author of “Irrational Exuberance” who predicted the housing crash of 2006, is more circumspect this time. He doesn’t predict a big crash but that the housing market will go sideways for two years – perhaps a fall of 10%. He argues there was some exuberance, but this was based on householders and investors wanting to lock in at 2% mortgage rates. With rates at 8%, this demand will evaporate.

High rents A fifth factor is that rents have risen substantially in the past few years, making it attractive to buy a house, if at all possible. However, very interestingly in recent months, rents have started to fall. The number of new apartment units being built is at a 50-year high, with more than 460,000 being completed this year alone. Over a million new units have been built in the past three years. This will put downward pressure on rents, and also affect house prices in 2024.

But, despite these factors, others such as Charlie Munger are much more pessimistic about US housing and fear 2024 could see bank losses and falls in property values.

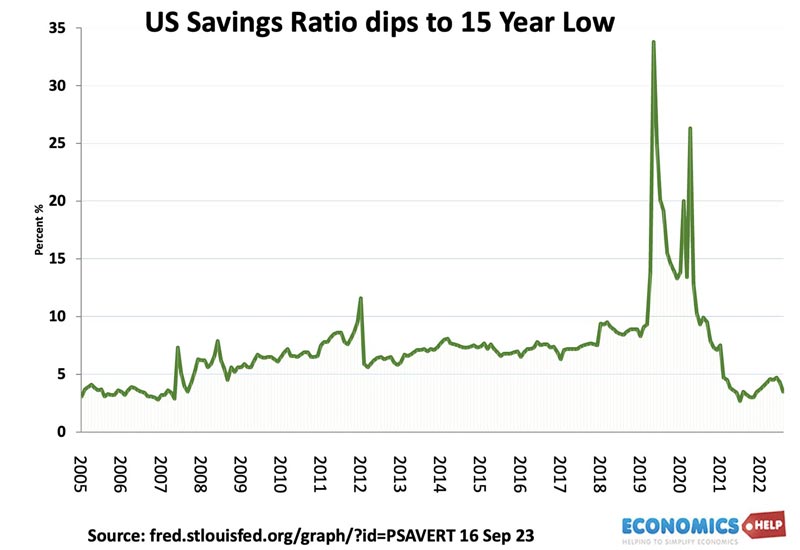

Firstly, the American boom in growth and housing demand has partly been fuelled by a dramatic drop in savings. The US saving ratio has plummeted as households deal with rising living costs by dipping into savings. But, these pandemic savings have been exhausted meaning that the strong growth in demand cannot be maintained by this avenue. Higher interest rates will increasingly bite as firms and households face higher costs on loan repayments.

Another area of concern for US property is in commercial property. The shift to working from home has seen a sharp rise in office vacancy rates. Buildings are not in demand and this is causing the value to fall. Many small and medium sized banks who lent for commercial real estate are at risk of bad loans. When house prices falls, homeowners have to carry the burden of negative equity. But, in commercial real estate, loan arrangements are different. Investors can walk away and the equity loss is covered by the banks not the investors. The property estate market has not yet adjusted to both new working practices and higher long-term bonds.

US Economy Prospects?

The real risk to the housing market in 2024 would come from the economy, if higher interest rates finally bite, then it could lead to the long-anticipated recession. Falling demand, rising unemployment would precipitate home sales and falling prices. With thin volumes a small change in market conditions would cause big change in market sentiment and prices.

The good news on the US economy is that after years of exceeding forecasts, inflation has fallen faster than expected. It is now 3.7%, with core inflation suggesting it should fall further. Should the economy slow down next year, it becomes easier to reduce interest rates than if inflation had remained stubbornly high. Certainly, 12 months ago, few economists believed inflation could fall so sharply without a bigger cost of recession and unemployment. But, helped by government stimulus and falling oil prices, the decline in inflation has so far been almost pain-free and this has improved the prospects for the economy.

However, the closer we look at US economy, there are other reasons to be concerned. 60% of Americans are still living paycheck to paycheck with high personal debt levels.

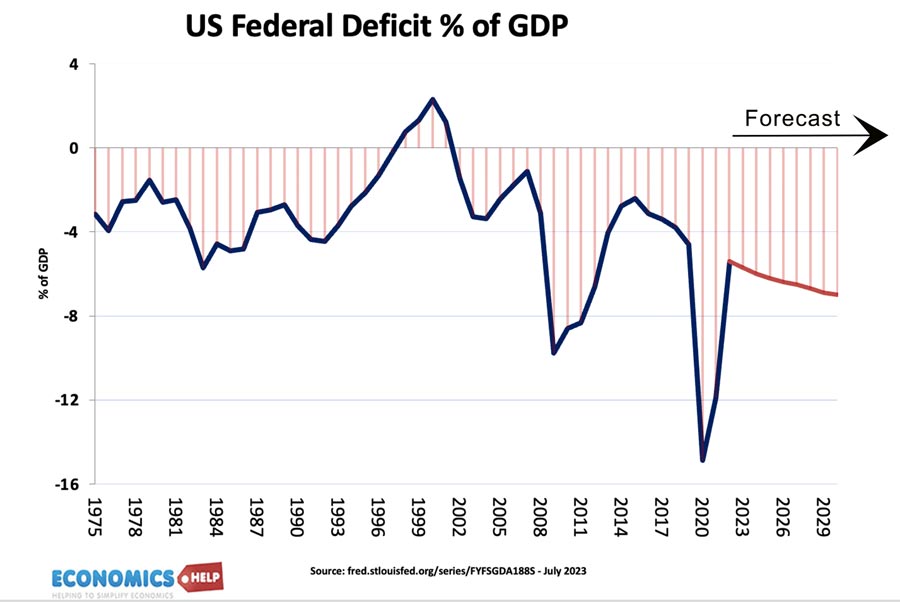

The US government is also running a record budget deficit for this stage of an economic cycle. The Inflation Reduction Act was ironically a big fiscal stimulus but, the question how long can the US maintain economic growth from government and private debt.

Conclusion

US house prices are substantially overvalued compared to incomes and mortgage rates. But, with interest rates rising above returns from renting, it will cause big shift in investment over the next months. Therefore, there is strong chance prices stagnate or fall in next few years. But, circumstances are also different 2006 crisis, with homeowners having much better credit ratings and more insulated from interest rate rises.

Related

- Why is the US economy doing so much better than the UK Economy?

- Why Do Americans Feel Poor, When America Is So Rich?