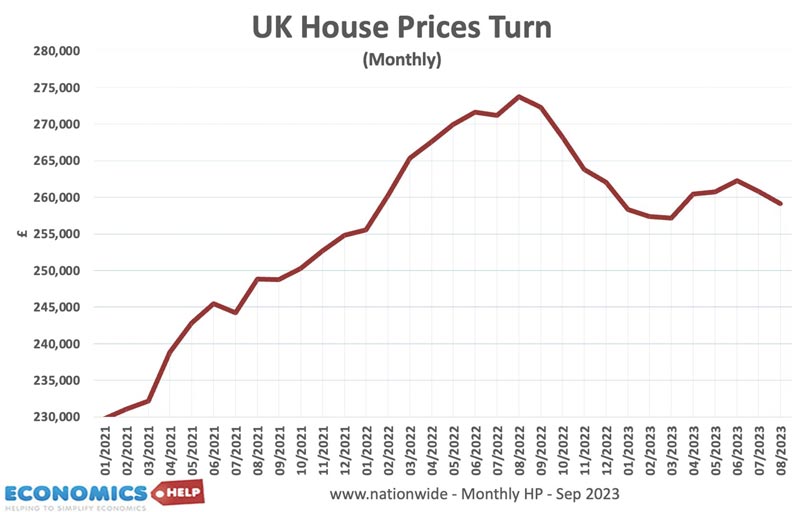

UK house prices are overvalued, which is why prices have started falling in most regions across the country. But, the big question is how far do prices need to fall? And where are prices most overvalued?

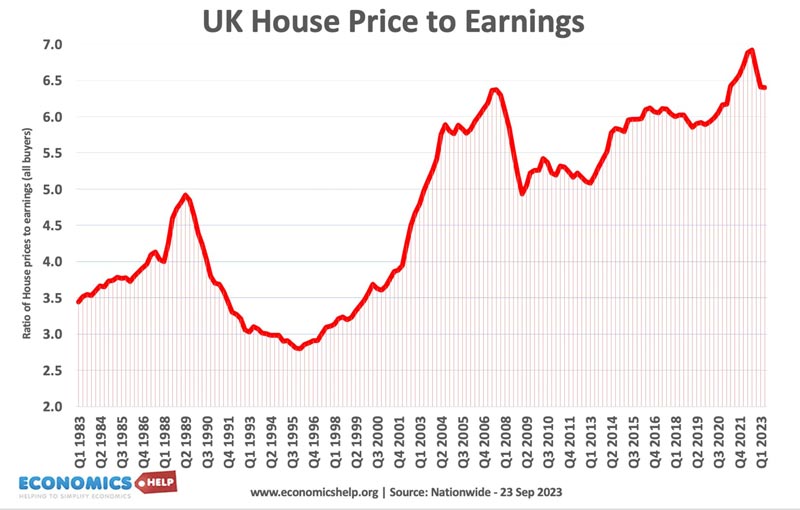

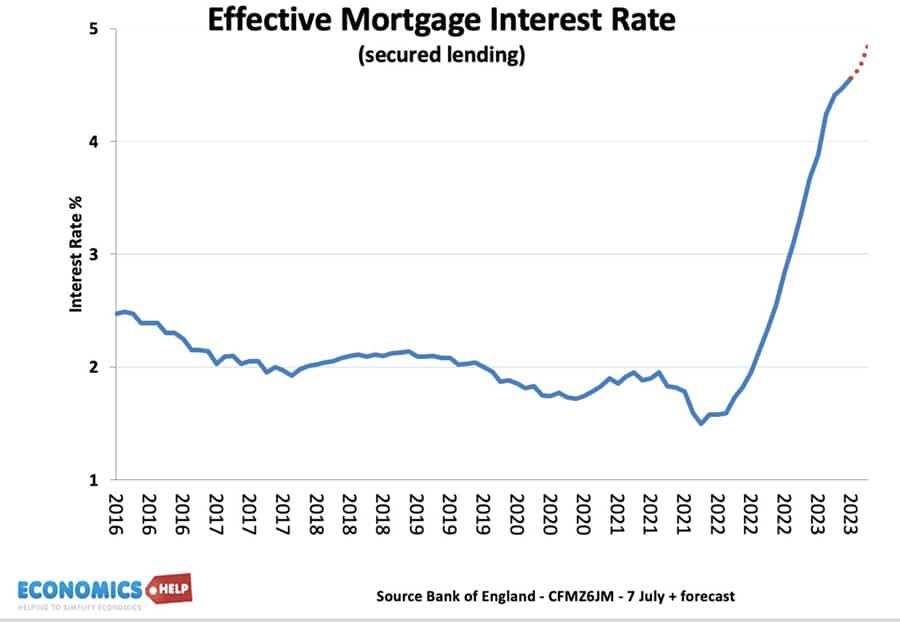

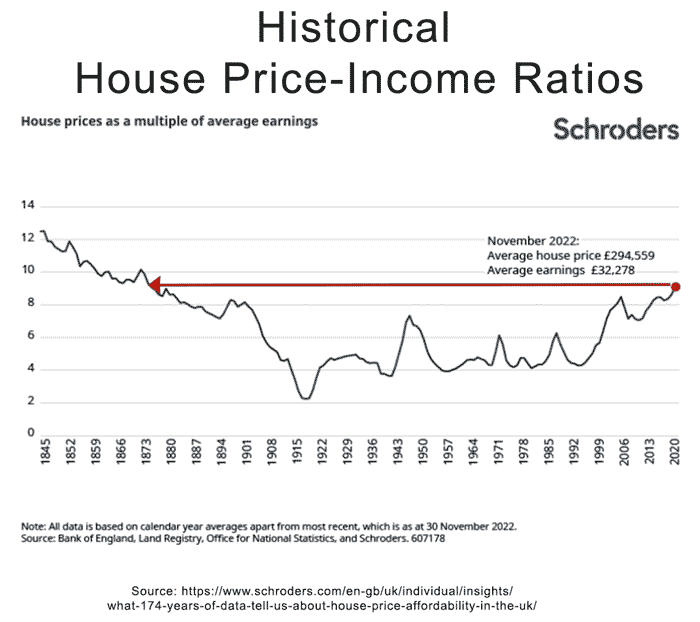

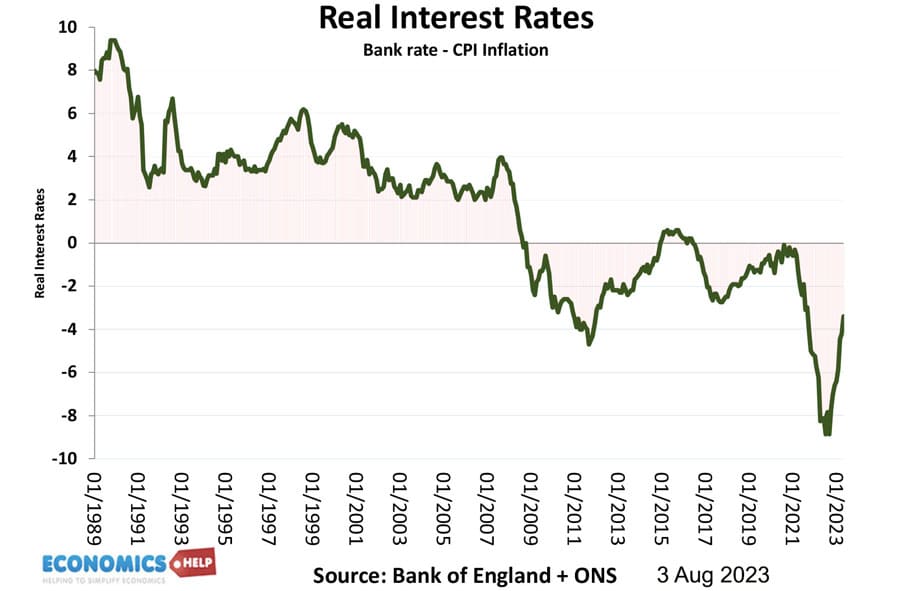

In the aftermath of the 1990s recession, UK house prices to income ratios were less than 3, but over the next 30 years, prices rose not just faster than inflation, but also faster than wages. Reaching a peak in mid 2022. The ONS method states the price to income ratio is nine times earnings. So it is no wonder many of the young generation have given up getting into an overvalued property market. The primary reason house prices became so divorced from incomes was that we had an unusual period of ultra-low interest rates. In 2021, mortgage rates were just 2%. You could argue that people taking out a large mortgage in 2021 at an interest rate of 2% were acting in a rational way, When its so cheap to buy, why not?

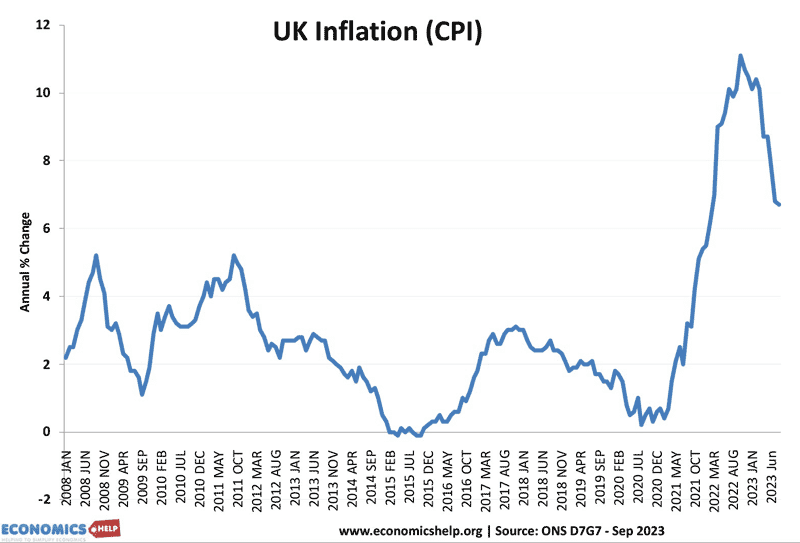

The only problem was that after 15 years of zero base rates, we had an unexpected inflation shock. Covid, rising gas prices, and strong demand all led to a surge in inflation, which took the Bank of England by surprise. The result was after years of calm, interest rates were increased 14 times in a row. Recent falls in inflation have made the outlook a little less glum, but the big picture is that interest rates have doubled, The economics of the market has changed drastically. Zoopla report buying power has fallen by 20%. Other calculations show first time buying power has fallen 30%. Suppose you can afford £1,000 a month mortgage payments.

In 2021 with rates at 2%, you could get a mortgage for £270,000. Now that rates are 5%, the same monthly payments get you £186,000 – a 30% decline. It doesn’t necessarily mean house prices are going to fall 30%. But it does give a clear indication of the shock to buyer demand. A

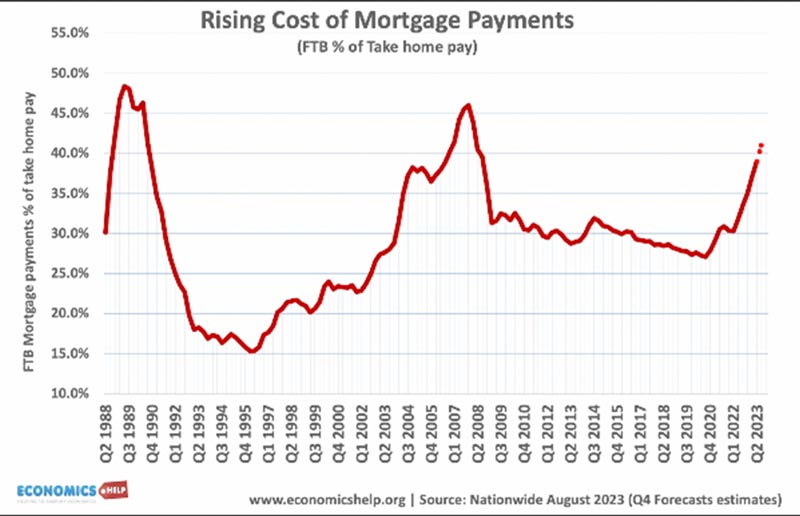

If we look at the ratio of mortgage payments to income, there has been a clear fall in affordability, it is getting close – though not quite as bad – as the last two crashes in the 90s and 2008.

If we look at long-term affordability, there has been a divergence from the historical average. House price to incomes were last this high, when Queen Victoria was on the throne.

Yet, so far this decline in affordability and overvaluation has not been reflected in prices – why not? It is true house prices have fallen 5-6%. Yet, mostly the decline in affordability has been reflected in a decline in transactions. The market is grinding to a halt, sellers who don’t want to reduce prices are finding it hard to sell. At the same time, housing chains can easily fall apart. My parents have been trying to move since February 2023, twice the chain has fallen through. One reason house prices are still overvalued, is that the whole market is slow to adapt to a change in conditions, like a big ship, you can’t change course straight away. There is too much momentum.

Now with the housing market, it is always possible to find examples of big house price drops and even house price rises. Why is this? Firstly, the housing market is highly regional. So far house price drops have been concentrated in the south, because that is where house prices are most overvalued. There is a huge difference between house price to income ratios in Scotland and the south east. It is the south east, which will be most affected by rising interest rates. Even within regions, prices can vary enormously by location. Another thing is that it is definitely possible to be guilty of confirmation bias. I follow different people on the housing market, some will always find examples of big house price falls, and others will find examples of prices holding up. The market is so varied, you can find data more suited to your preference.

But, whether you’re an optimist or pessimist on prices, there is an underlying economic change, which is quite profound. Buyer demand has fallen and there are many factors pushing prices down. I was glad to see better than expected inflation figures last month, but even if we are pretty close to the top of the interest rate cycle, we still haven’t absorbed the past rises. In the coming months, those on fixed-rate mortgage deals will face higher mortgage costs as they remortgage. And homeowners are making drastic changes to meet mortgage payments, and this will become more common next year. Interest rates have a time lag of up to 18-24 months, so 2024 will be grim for many households, and this will feed into weaker economic growth and lower spending, which will be another downward pressure on buyer demand.

State of the economy

There is one factor, often ignored in house market forecasts, and that is the state of the economy. In recent months, the housing market and rental market have been buoyed by a strong labour market, unemployment has fallen, and nominal wages have been growing. However, is this now set to change? The Bank of England forecast for the UK economy is a rise in unemployment and near zero economic growth. But, I think there are reasons to be more pessimistic. Real wages have fallen considerably in recent months, and it will take a while for this to be reversed. The impact of higher rates, will slow down the economy considerably next year. Also, falling house prices will themselves slow down the economy. But, the effect will not be felt equally, those who own a house outright and with savings will not really be affected, they could even see positive real interest rates for the first time since 2008. But, renters, mortgage holders will all feel like they are being squeezed deeply. There is less money going around and the crisis affecting the high street will only worsen. Now, I should add a caveat. Last year the Bank of England forecast a recession, which didn’t quite materialise. The economy was more resilient than expected, but still recent data is pointing to sharp slowdown in output, spending and investment.

Will prices have big drop?

What about the forecast house prices to fall 35% peak to trough over 2-3 years made by Charlie Lambdin. His reasoning is threefold 1) Interest rates rising to “normal levels” 2) Real wage falls 3) Deteriorating economy causing unemployment and rise in arrears. Firstly, I admire people who are willing to make bold predictions along way from more conventional forecasts, which may be subject to group think. Secondly, the basic reasoning is correct that the housing market needs a correction. In 2022, many industry expects were still predicting modest rises or stagnating prices, but the market has turned with conventional forecasts becoming more pessimistic than last year. I’m not a great fan of making predictions, but when I was debating house prices with housing bull Russell Quirk on talktalk tv, I said my best guess would be a 15-20% nominal fall peak to trough. But there are six reasons I don’t expect a bigger 35% fall.

Firstly, high inflation is improving affordability, through a rise in nominal wages. You can reduce house price to income ratio by either falling prices or rising wages. Real house prices have already fallen 11% since 2022 (and nearly 20% since 2002). Secondly, although buying power of first time buyers has fallen 30%, this is offset by a desire to escape the rented sector and do whatever it takes. When we say house prices are overvalued, overvalued against the alternative. Higher interest rates mean buying is not more expensive than renting, but it is not 30% more expensive. Those who can buy rather than rent will try to do so. This could involve getting a longer mortgage term and saving for a bigger deposit If we go back to our example earlier in video, if we change the mortgage term from 30 to 40 years, we can borrow an extra £20,000. Hardly a panacea and pretty expensive, but a little help. A more important factor is using wealth of parents – the bank of mum and Dad this is one reason to explain some of the rise in house price to income ratios in past few years.

Thirdly, if you look at past crashes of 90s and 09 nominal prices fell 20%. I don’t think conditions are much worse than the early 1990s. Unless there is a very deep recession and rise in unemployment, it would take a lot to get arrears close to the levels of the 1990s. In the 1990s a lot of the fall in house price to income ratios, came from rising incomes. But, it is interesting to note the time lags – how long it lasted 5 years before prices started rising again. In 2009, prices fell 12 months after steep rise in interest rates in 2007-08.

Fourthly, if the UK was to see a deeper recession than predicted – which could easily happen, then inflation will fall more rapidly in 2024. The Bank already predict inflation to fall to 2% in 2025, but if there is a sharp rise in unemployment it could fall even quicker. If we do get a deep recession and sharp fall in inflation, interest rates might be cut. Why?

For the past 15 years, we have had negative real interest rates, interest rates less than inflation. If inflation is 2% and the economy is in deep recession, would the Bank of England really keep interest rates at 5.2%? Real interest rates of 3% would be deeply damaging to a depressed economy. In other words, I think it could be unsustainable to have relatively high real interest rates. Now some argue structural inflation has risen and if oil prices shot back up to £150 we could again see a renewed bout of cost-push inflation. But, a deep recession would also bring back the deflationary pressures we saw in the 2010s.

So to conclude, house prices are overvalued and have not yet fully readjusted to new economic climate. In the coming months we are likely to see more falls in the house price to income ratio – both through falling house prices and rising nominal wages. But, given market is grim, what should we do if we are a buyer and or seller. This video goes into more detail on the tricky issue of whether to buy in a declining market.