2010 will be a difficult year for the UK economy. After the deepest recession since the 1930s, the outlook is for a sluggish recovery. Though recovery is welcome, it still leaves the problem of spare capacity, high unemployment and record levels of peacetime government borrowing. It will be a difficult tightrope between boosting economic growth whilst keeping borrowing under manageable levels.

Economic Growth

Source: ONS

The economy is expected to recover in 2010, but give the depth of the recession, output is well below full capacity. It would take a long period of economic growth to overcome the spare capacity.

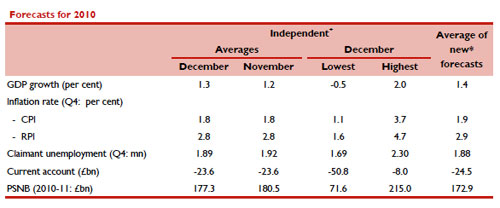

Forecasts for Growth in 2010

Source: HM Treasury – forecasts for UK economy December 2009

Factors Favouring Strong Economic Recovery

- Unprecedented monetary policy of 0.5% interest rates and quantitative easing

- 20% depreciation in the Value of Sterling helps exporters and domestic demand

- Signs of Stronger recovery in Europe – our main trading partners

- House price falls have ended in 2009, this should help stabilise wealth and confidence

Factors Undermining Economic Recovery

- Size of Budget deficit is putting government under pressure to rein in borrowing through higher taxes or lower spending. This deflationary fiscal policy will reduce demand and could damage an economic recovery.

- Signs that British consumers are becoming more attached to saving and are reluctant to spend

- Balance Sheets of Banks is still poor leading to reluctance on their part to lend.

- Possibility of second fall in house prices.

Unemployment

Source: ONS

Unemployment is the most serious problem facing economy with over 2.5 million unemployed. However, as we noted here – Why is Unemployment not higher? – the rise in unemployment could have been expected to be much higher given depth of recession

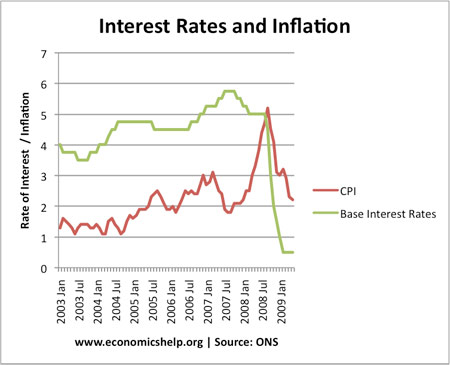

Inflation

Inflation is currently 1.9% (Dec 09) – just below the government’s target of 2%. Inflation forecasts for 2010 suggest cost push factors (tax rises, oil price rises) may push CPI above the inflation target. However, this rise in inflation is likely to be temporary and doesn’t reflect an underlying spare capacity in the economy.

In fact there is still a worry over deflationary pressure. Given level of spare capacity and unemployment rate, inflation is not a significant concern for 2010.

Interest rates are likely to remain low throughout 2010

Balance of Payments

Source: ONS retrieved Dec 14th 2009

One of the surprise of the UK economy is the persistent current account deficit despite –

- Depreciation in the pound

- fall in consumer spending.

See: Reasons for persistent UK current account deficit

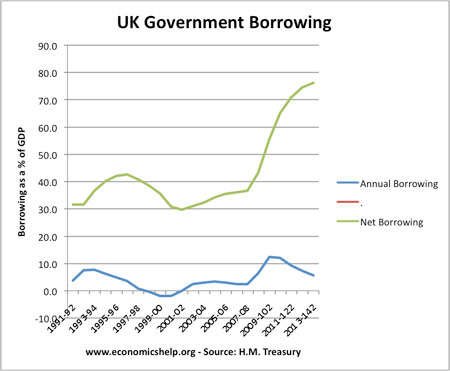

Government Borrowing

source: ONS

The rapid rise in Government borrowing has been one of the most unwelcome features of this recession. Tax revenues have collapsed after the rise in unemployment, fall in house prices and fall in wage growth. At the same time, spending on unemployment benefits has increased. This cyclical deficit has highlighted the underlying structural deficit.

One of the challenges of 2010 and 2011 will be reassuring markets that the government have a realistic plan to bring borrowing under control without endangering the economic recovery. If markets don’t trust plans to reduce borrowing, the UK could have its AAA credit rating downgraded – this would make it more difficult and expensive to borrow. But, if taxes rise too quickly it could cause a fall in GDP.

National Debt is currently £830bn or just under 60% of GDP. But, with a budget deficit of approx £180bn forecast for 2010, this will rise rapidly.

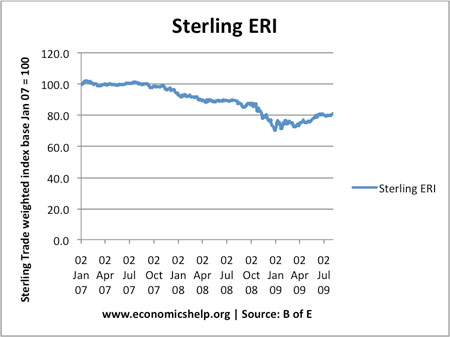

Sterling

Sterling has been weak since 2007, reflecting the fact the UK economy has been one of the weakest performers out of the OECD. It would take a strong recovery and prospect of higher interest rates to strengthen sterling.

Though Bank liquidity has improved from the depths of the credit crunch, lending conditions are still far from normal hampering investment and the housing market.

Related

GBPUSD shall rise up to 1.6 in a short term prediction.

Some forex traders expect high up to 1.7 by Mid year or September this 2010.

All existing facts give us indications that the UK economy is still in a bad shape, believe the market is unstable and will go into a gray area of uncertainty, potentially get us back into recession.. Yet I am in the Medical field and not economist but been watching the market carefully over the past couple of years and my analysis is based on history trades and political agendas..

Wall Street Journal is of great help in presenting relevant subject matters at the door step of my research. Lending mortgage money is very low on the banks’ list of priorities. The mortgage lending profit margin is very unattractive. They love 18% on loans. Research regarding the banks financial position clearly shows poor basic banking fundamentals are still a huge problem. Their balance sheets are peppered with complex foot-notes making it difficult to ascertain what is really going on. Fortunately, most top banking officials responsible for the banking mess are leaving through attrition or forced out. Over time, the banks will eventually be able to show a straightforward balance sheet and able to provide mortgage money money again. Not soon enough though.

CHANCE KORSE,

TEMECULA, CA