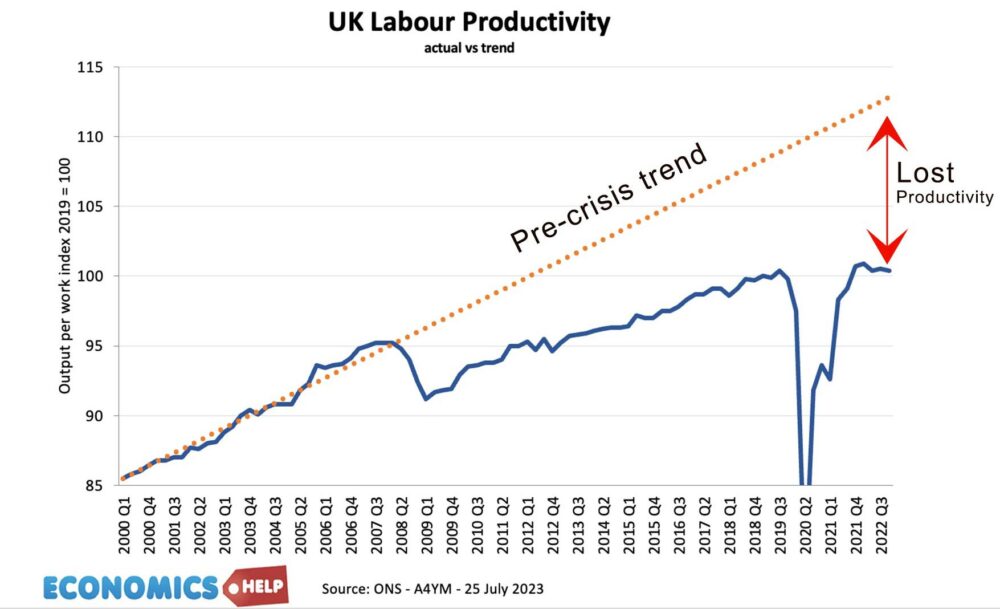

The UK economy is in dire straights. High inflation, low growth and rising debt. Since 2007, productivity has slowed down, leading to lost output and one of the worst growth rates in the OECD.

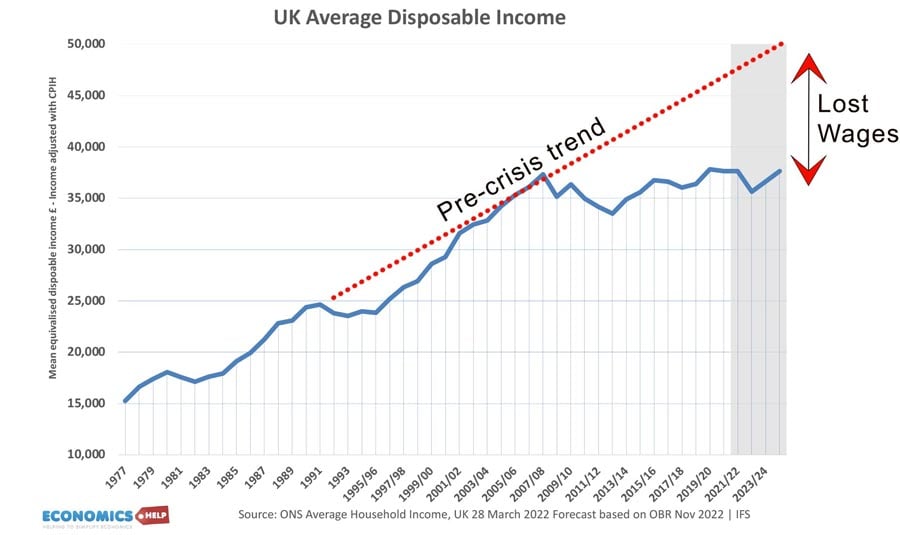

The brunt of the slowdown has been felt by average workers, who have seen an unprecedented fall in real wages and now on top of this, face a surge in mortgage payments.

The UK’s economic malaise, is shared across the political spectrum. But, the real question is could a new government actually reverse this decline?

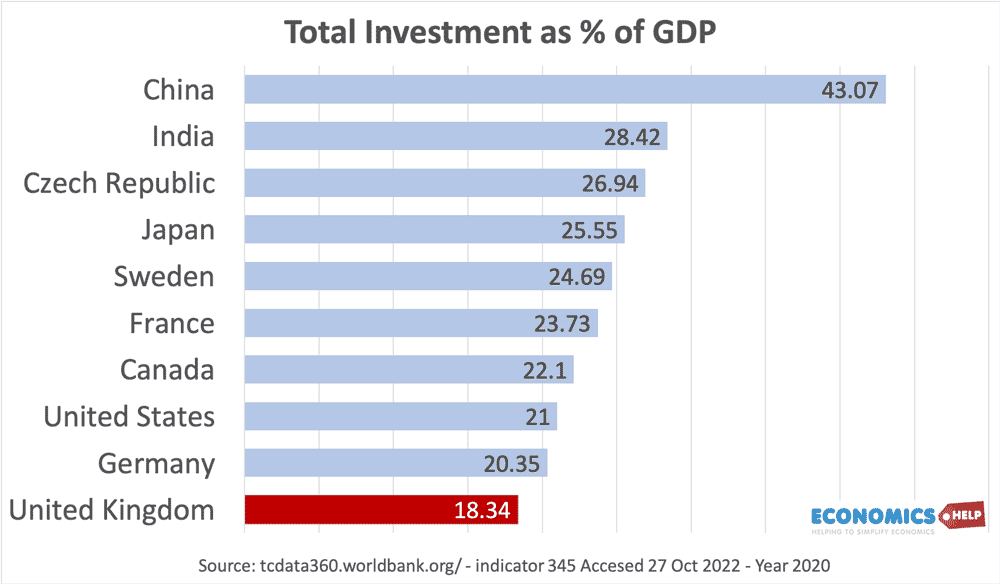

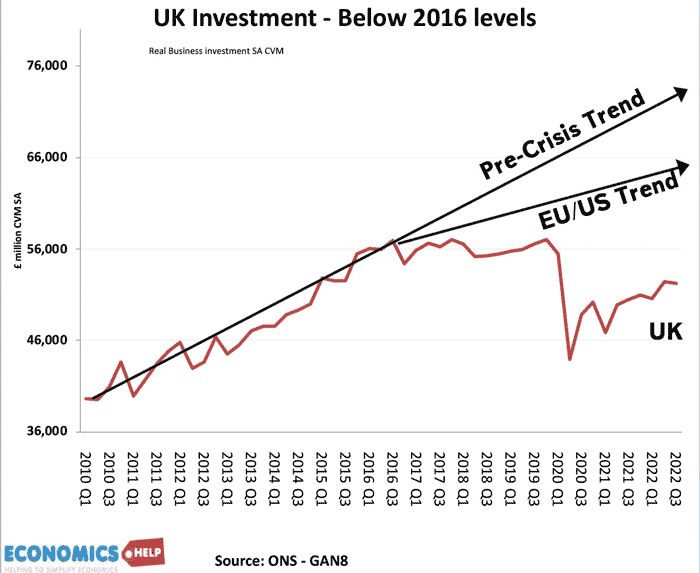

Investment decline

UK investment is one of the lowest rate in the OECD and in recent years has fallen behind Europe and US.

One reason for low investment is the uncertainty of previous years. For example, tax rates have fluctuated. Large cuts, followed by large rises. The process of Brexit also created considerable uncertainty with firms unsure, of what future trading relations would be. It seems Keir Starmer is being ultra-cautious with a reluctance to make any bold policy commitments. This may disappoint many, but ironically businesses would probably appreciate a degree of stability and less radical changes. Without seismic shocks like a no-deal Brexit or the mini-budget fiasco, it would be a start for encouraging investment.

Green New Deal

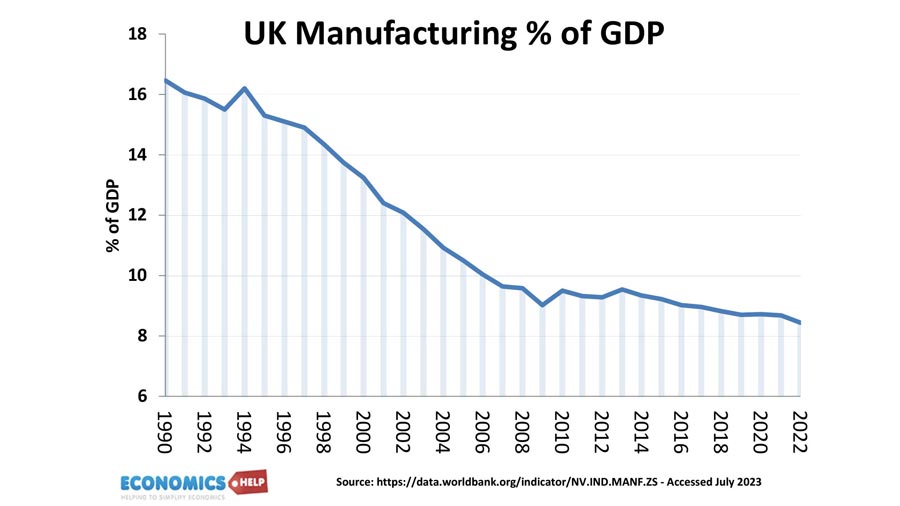

But, being ultra-cautious is not enough, UK industry has been in relative decline for years. To revitalise manufacturing, the UK may look to the US, where the Inflation Reduction Act of 2022, saw a boom in manufacturing investment as firms have invested in green technologies to benefit from government subsidies. It is a reminder that bold government policies can stimulate the kind of investment, which benefits the economy, energy independence and long-term environmental goals. The problem is that the US has started a trend for expensive government subsidies requiring considerable commitment. The UK reportedly had to pay £500 million for a Tata battery plant in the UK. But Labour has already delayed their modest Green New Deal to the second year of office. There is substantial international competition for renewable energy, and the UK risks getting left behind. A complement to big subsidies is the greater use of carbon taxes to pay for the energy transition, but will a new government dare raise taxes?

Fiscal Responsibility

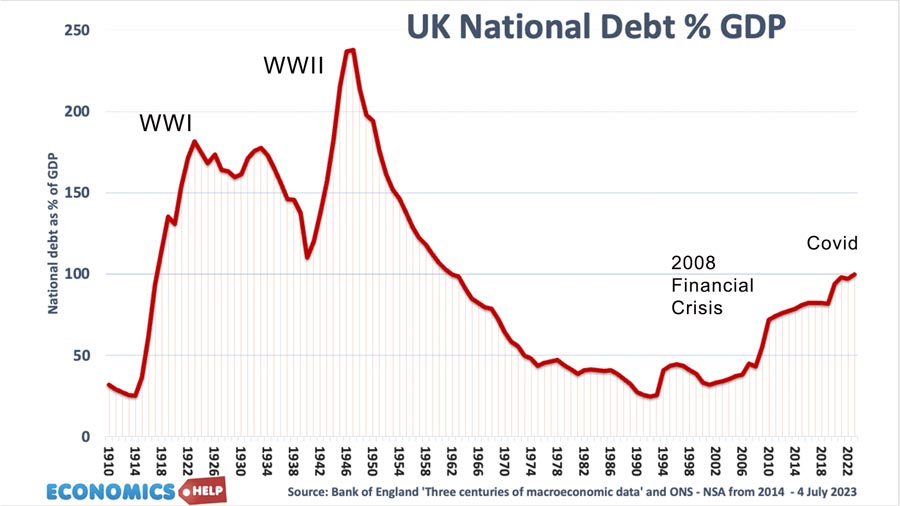

Keir Starmer recently stated he was a fiscal conservative and would only borrow within narrow fiscal rules. Given the expected deterioration of public finances, this will severely limit the scope for public investment. In 1945, the Labour government inherited much higher levels of debt 180% of GDP, but borrowed even more, setting up the NHS, welfare state and building houses. Debt soared to 240% of GDP, but it didn’t damage the economy, it led to a post-war economic boom. However, unfortunately 2023 is very different. Low growth, high inflation and high interest rates have seen debt interest costs soar, making government borrowing much more tricky than say in 2010. However, whilst there is some justification for being concerned about long-term debt, it is a mistake to reject public sector investment because of debt fears.

Public sector investment can lead to improved economic growth, higher productivity and hopefully greater energy independence. A lesson from the 2010s is that best way to deal with debt is not just austerity and caution, but seeking higher economic growth, which will lead to higher tax revenues. For example, investment in energy independence makes the UK less vulnerable to a future oil price shock, which really cost the UK economy in 2022. The problem is that a Labour government may be worried about a media obsession with the debt like in the 2010 election, and so they tread an ultra-cautious path, which keeps the UK stuck in low growth, low tax revenues and low investment.

Brexit

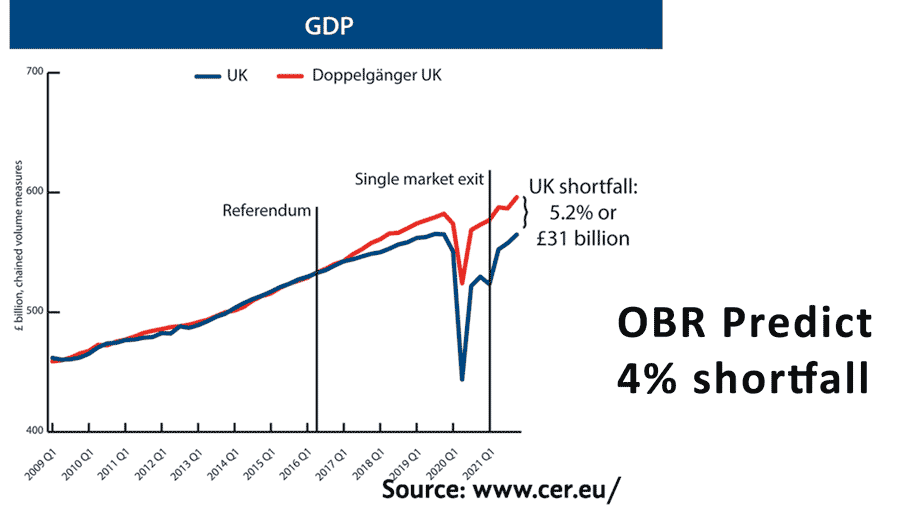

Another factor behind UK’s recent poor economic performance is the impact of Brexit. Estimates suggest it has led to 4-5% loss of GDP, due to uncertainty, higher tariffs, increased frictions, loss of European labour and lower investment. Interestingly the OBR stated that it expected Brexit to cost 4% of GDP, but it seems to have happened quicker than they expected. The lower growth has also hit tax revenues by an estimated £40 billion lower than expected. Repairing relations with Europe, greater regulatory alignment and moves to return to Single Market, present easy potential gains to future economic growth. Labour is very cautious on Brexit – despite a large majority supporting closer ties to the EU. But, after the election, there is potential scope for slowly unwinding the more costly effects of Brexit on British business.

Labour Market Participation

However, whilst it is tempting to blame Brexit for the UK’s economic problems, it is only part of the jigsaw. Poor productivity preceded Brexit and rejoining a single market would be no magic bullet. The IMF recently pointed out that since covid, the UK has had one of the largest declines in labour market participation. The main cause is ill-health, especially amongst the older population. A key challenge for future economic growth is to get people back to work. But, for a government to tackle ill-health is a very difficult challenge. It is at least partly related to the crisis in the NHS which has seen a surge in waiting lists in recent years. To reverse waiting lists will be both expensive and slow, especially with forecasts of long-term disease getting worse. With low economic growth and weak finances, any new government will find it difficult to increase spending to keep up with demand. Even throwing money at the NHS is no guarantee of success. Given the ageing population and decline in participation, immigration remains a pathway to growth.

A government really looking to the long-term, would make a big effort to do more to prevent ill-health, rather than just deal with the consequences. For example, an increase in the sugar tax and encouraging active travel could all help improve a nation’s help. But, would a Labour government be willing to take a political risk to raise taxes on cars and unhealthy food?

Housing Market

Another real problem in the UK economy is the housing market. The UK faces a shortage of rented and social housing, which has caused rents to rise. This not only reduces living standards but also affects geographical mobility as people are reluctant to move to growing areas of the country because of the shortage of affordable homes. The UK has also been spending £22bn a year on housing benefits, effectively paying private landlords to fund expensive market rents.

The best policy to deal with overvalued house prices and rents is to engage in large-scale building of social housing and reinvest the rentable incomes rather than selling them off to the private sector. In this regard, there are more hopeful signs that Labour will seek to build more houses, but it will take time, plus the usual NIMBY pressures against building.

External Factors

It is also important to bear in mind, many of the acute problems facing the economy are mostly out of the control of the government. There is little a new government could do specifically to target high inflation and high interest rates, especially if it is from an external shock like the Ukraine War. In theory, they could use fiscal policy to reduce inflationary pressures, but that is very unlikely. The problem is that the housing market is hopelessly overvalued given current interest rates, and it is going to be a painful readjustment. The Lib Dems did propose a bailout for mortgage holders, but this would set a bad precedent, why should the government subsidise homeowners many of whom have done well from past price rises and low interest rates?

However, if house prices do fall considerably, it will help bring a greater degree of fairness to a housing market, which has provided wealth gains for some, but losses for others. But, it will be a painful readjustment.

Unequal economy

Another feature of the UK economy is how some are facing acute financial stress, but at the same time, some are doing very well. The wealthy are benefitting from higher interest rates. Whilst new homeowners are being wiped out. Company profitability is not too bad, but workers, especially public sector workers are seeing falling real wages. We are not all in it together. One thing a government definitely has the power to do is to redistribute between the winners and losers of the current economy. In the past few decades, wealth has grown much faster than income. There is a strong social and economic argument for the greater taxing of wealth and less taxes on working people. There is also a good case for greater carbon taxes on fossil fuels and using funds to invest in improving the insulation of UK homes. There is a good case for electronic road pricing to raise funds as petrol taxes decline. But, will a new government be willing to introduce new taxes to pay for the services the economy desperately needs?

In 1997, Labour inherited a very good economy: strong growth, low inflation and impressive public finances. In 2023, a new government could inherit an economy in recession, falling house prices, low investment, rising debt and underfunded services. However, although it is an unenviable situation, we should avoid excess pessimism, economies can be more resilient than we fear. With well-placed support, investment and stability, the long-term decline of the UK can start to be reversed. But, it does need considerable vision, confidence and willingness to take risks. But would a new government be willing to do that?

The BBC should use your analyses