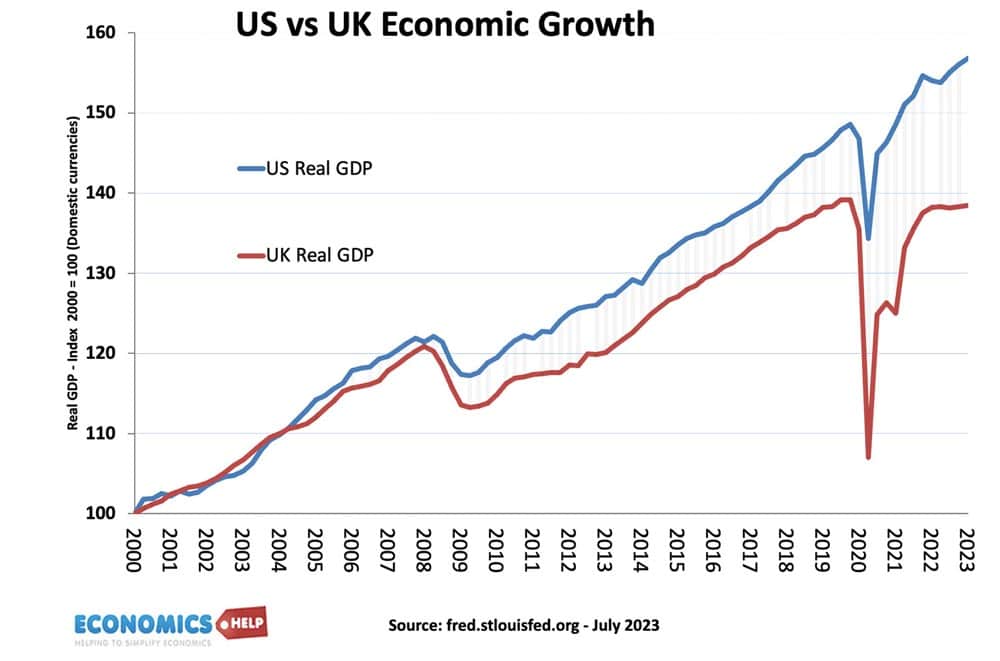

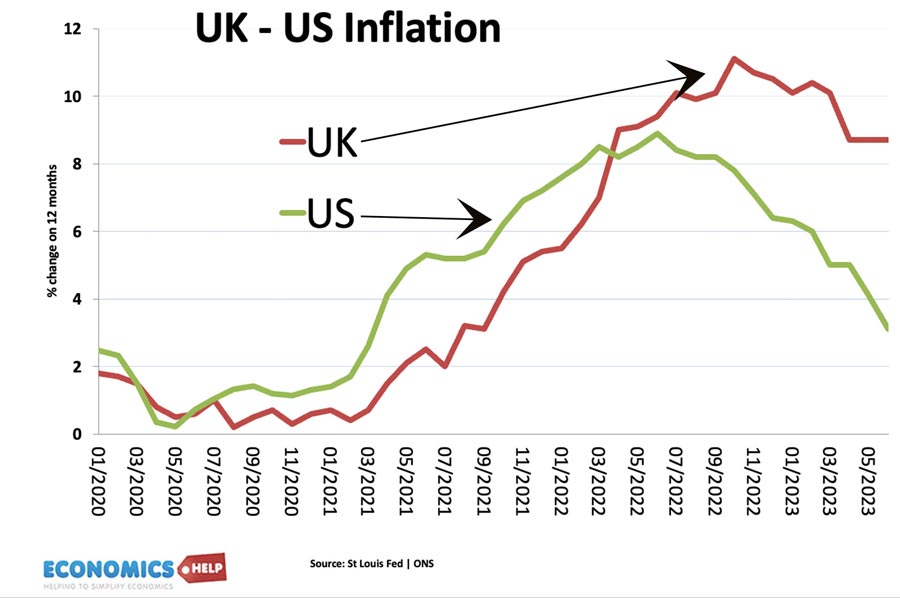

Since 2008, the US economy has grown at double the rate of the UK economy. Since Covid, the UK is stagnating whilst the US has grown strongly. Despite much faster growth, inflation in the US is dropping fast, whilst the UK seems stuck with high inflation and the worst of both worlds.

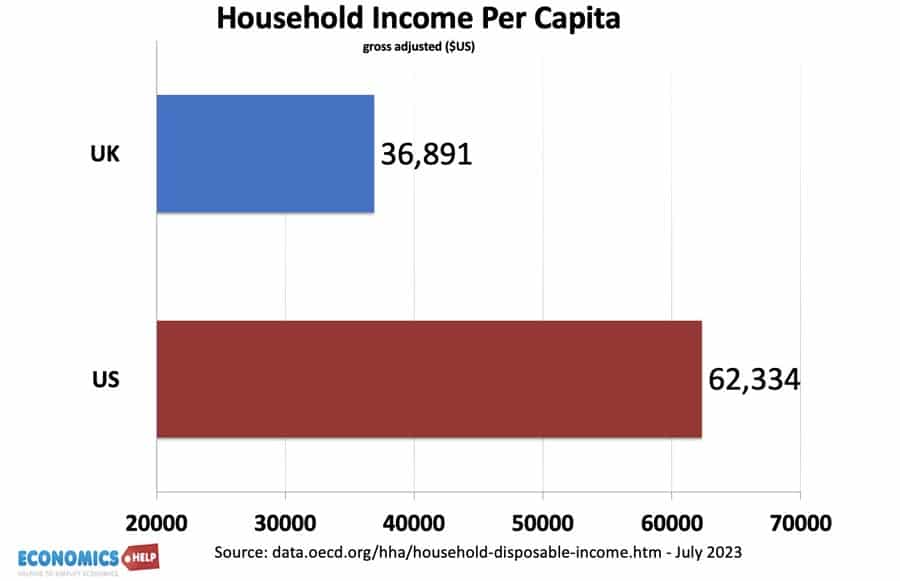

Average household incomes are substantially higher in the US, and the gap continues to grow. What explains the huge disparity in economic performance given the many similarities between the two countries?

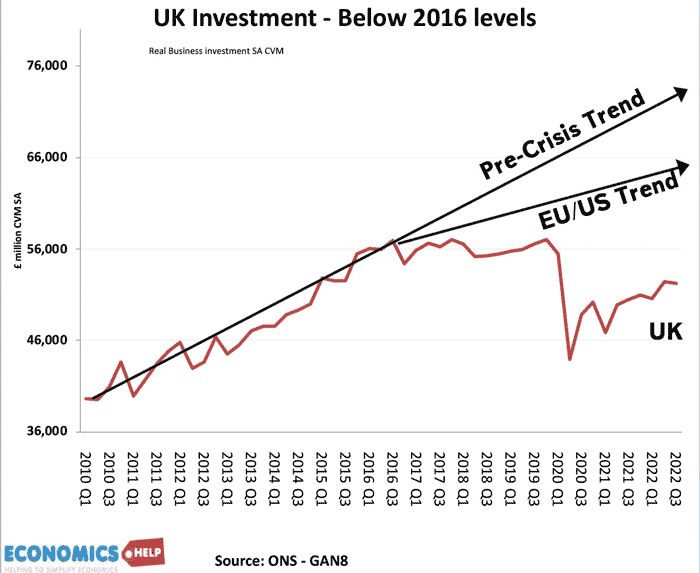

The US has hardly been a model of political stability, but the political turmoil has had relatively limited effect on the economy. The UK by contrast has been hit by a serious of shocks giving a sense of a rolling crisis, especially since Brexit in 2016. The sense of crisis and uncertainty has had a damaging effect on business investment.

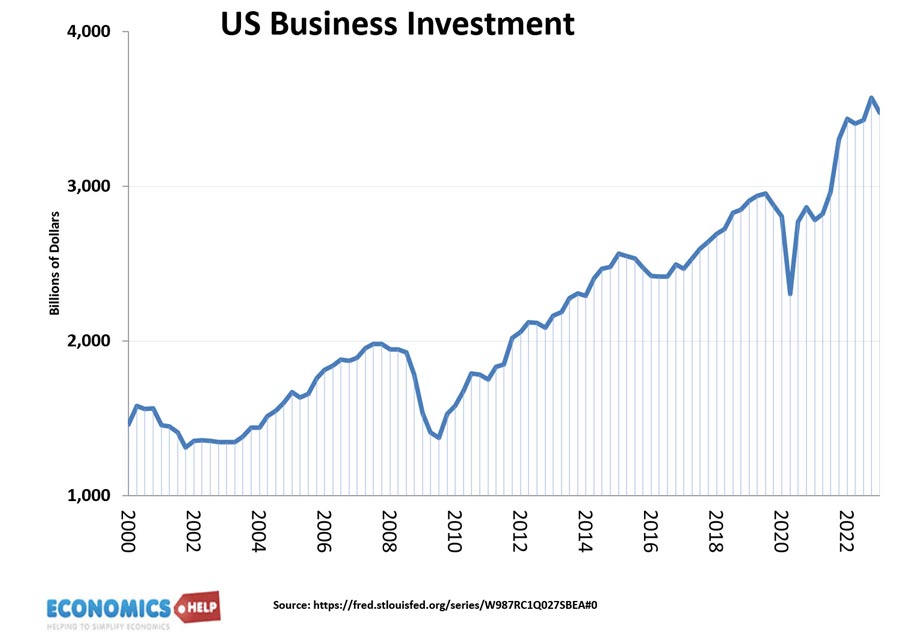

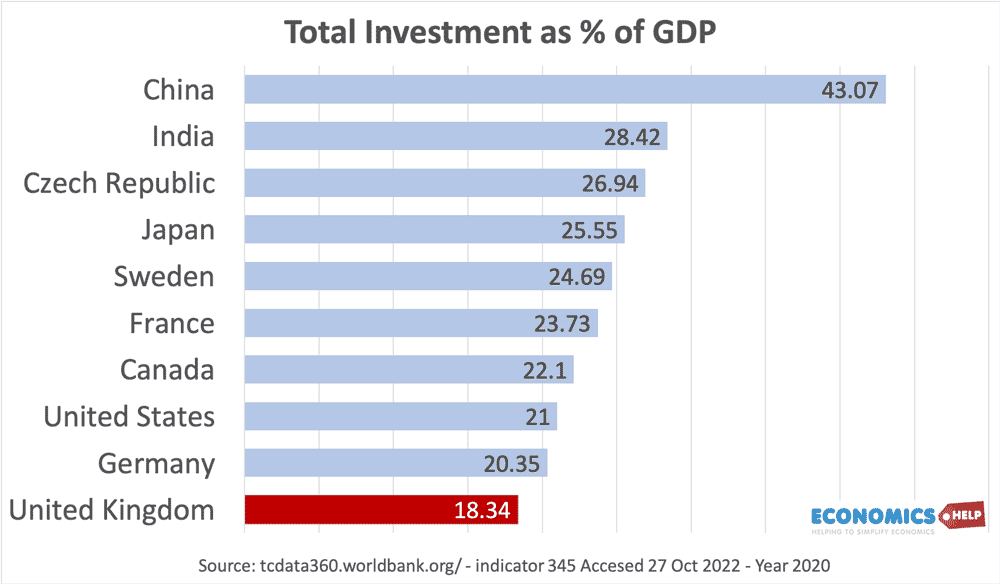

UK investment is still below the pre-Brexit peak and this undermines long-term growth. The US by contrast has seen a boom in private

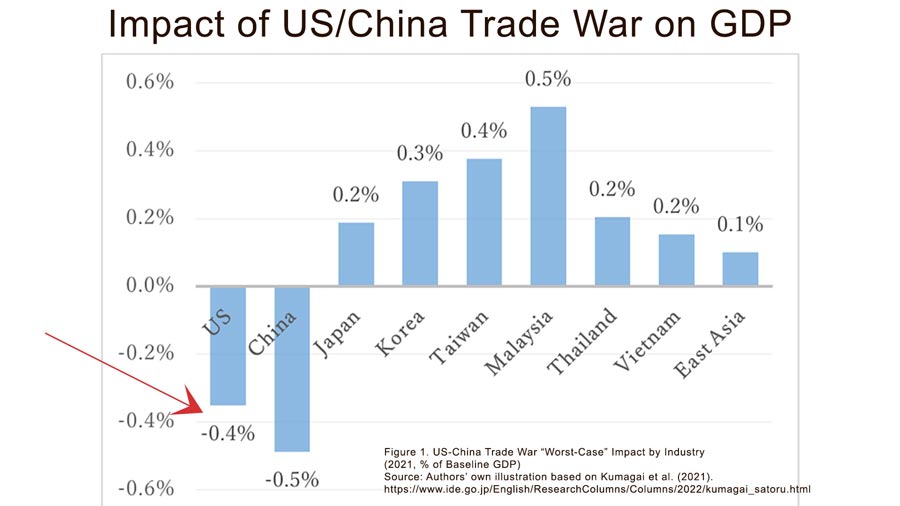

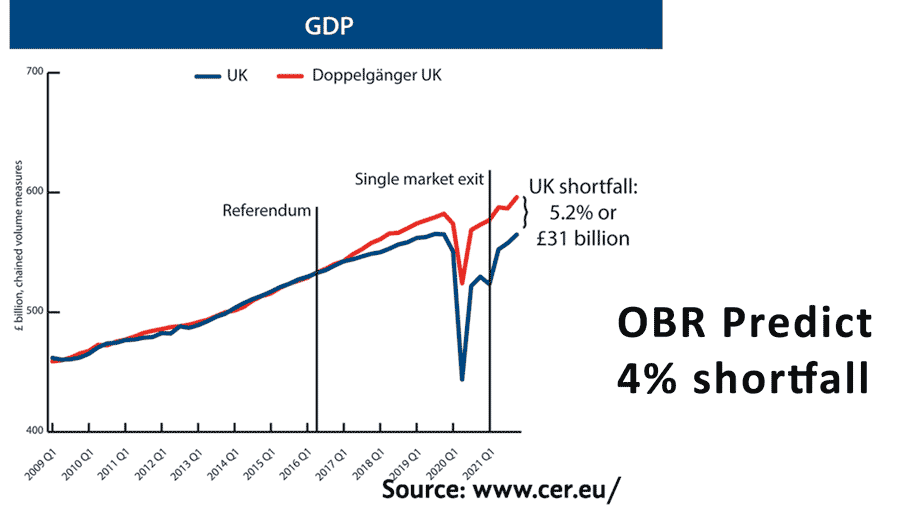

Under both the Trump and Biden administration there has been an ongoing trade war with China. But, this has been very limited with only a marginal impact on GDP. By contrast, the UK economy is struggling to adjust to the Brexit shock of new tariffs and barriers to trade. Estimates suggest Brexit has taken 4-5% off potential GDP – a huge shock given prior weakness.

The impact of the US trade war with China is estimated at a worst case scenario only – 0.4%. The only analogy of Brexit would be if the US had also started a trade war with its major trading partners like Mexico, Japan and Canada.

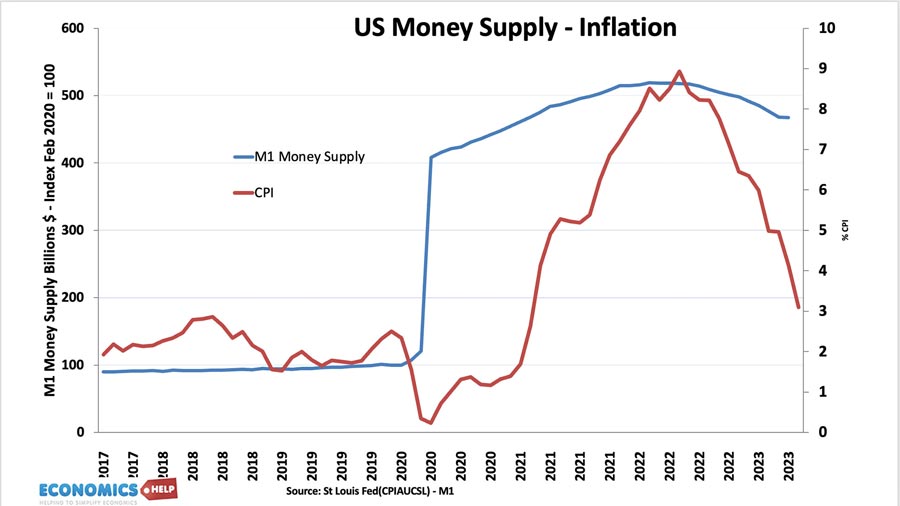

The other interesting comparison between the two countries is inflation. In 2021, both the UK and US experienced an inflationary shock, but there was a difference. In the UK inflation was almost entirely due to the supply side, covid shocks, rising gas prices, and the impact of devaluation.

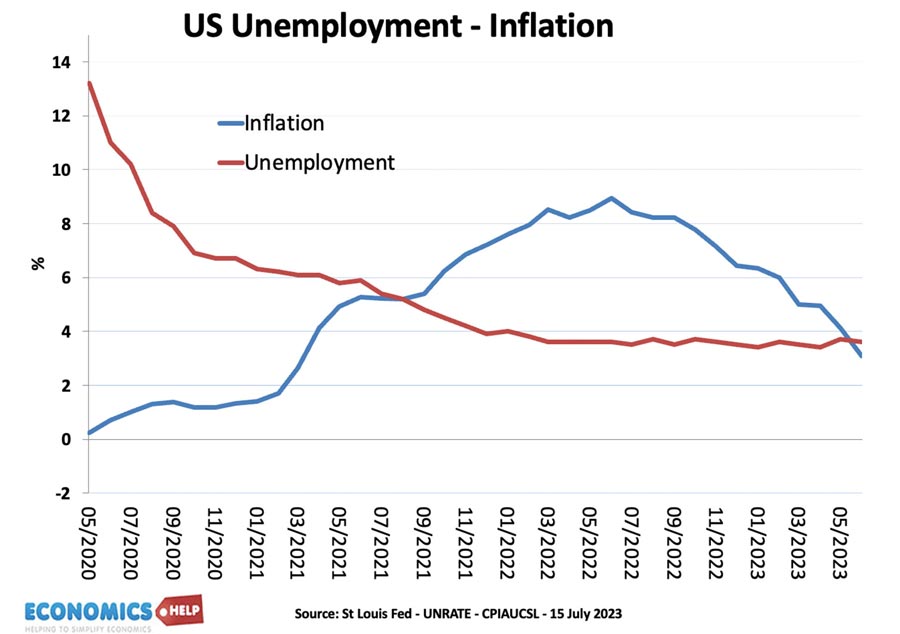

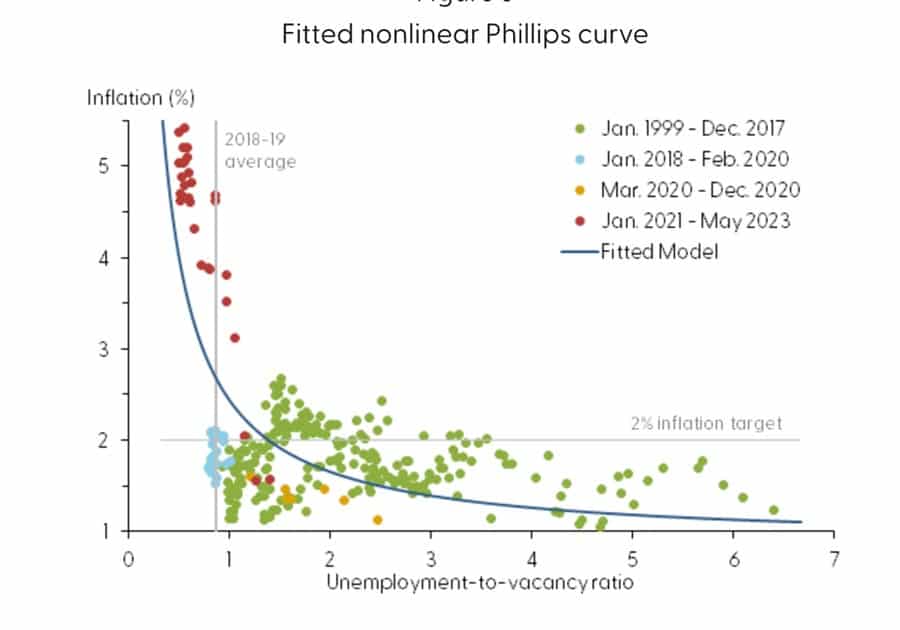

The US inflation was partly supply side, but also due to a very generous monetary and fiscal stimulus which led to an overheating economy and a hot labour market. In retrospect, it was too generous, but on the positive side, it led to a full employment economy. After 2021, the US has seen falling unemployment and rising inflation.

A classic Phillips Curve trade off. The UK by contrast had rising inflation, but very little economic growth to show for it. The worst of both worlds.

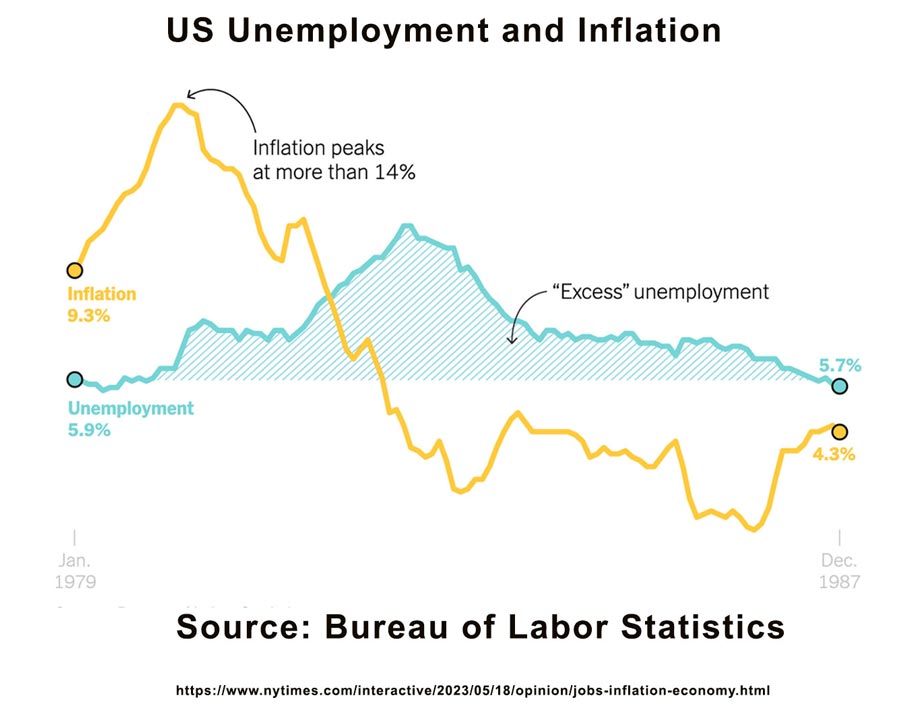

In 2022, there was a widespread prediction the US economy would enter into recession in 2023. The main reason was the rapid rise in US interest rates to reduce inflation would hit homeowners. Larry Summers made the bold claim that to get US inflation back on target would require a deep recession and two years of unemployment at 7.5%.

This analysis was based on the evidence of the early 1980s, when to reduce high inflation rate required a deep recession. The US also had an inverse yield curve, which historically has successfully predicted recessions. Yet so far, there has been little sign of a US economic slowdown. Revised figures suggested the US economy grew 2% in the first quarter of 2023 and the Biden administration have seen record job creation figures – helped by the bounce back from Covid. The UK by contrast has had static GDP barely avoiding recession.

The US is at least for now experiencing what economists like to call immaculate disinflation – falling inflation without any substantial economic slow down.

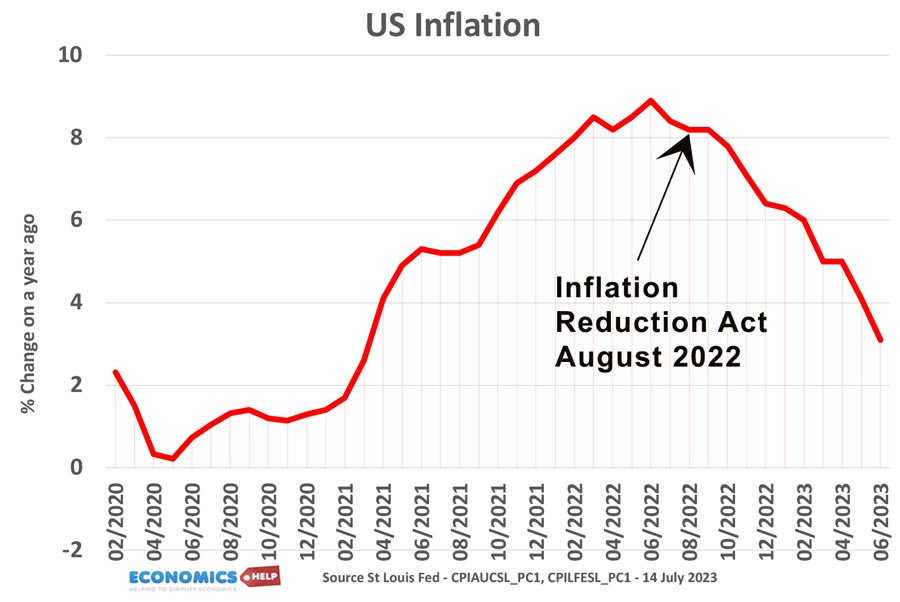

In 2021, the Biden administration passed the Inflation reduction act with immaculate timing, since its introduction, headline and core inflation has fallen quite sharply. The New York Fed’s measure of underlying inflation fell to just 2.5%.

Now the fall in inflation had almost nothing to do with the Inflation Reduction Act, which wasn’t really about reducing inflation anyway. A more accurate name for the bill would have been a Green New Deal. But whilst it does little for inflation in the short-term, there is strong evidence that the generous subsidies for switching to renewable energy and green cars are creating something of a boom in investment and manufacturing.

It is proving more expensive than intended but is also supporting the kind of economic growth that is highly desirable, not just stimulating demand, but encouraging investment in the kind of technology which will reduce dependence on fossil fuels. In the very long-term, a country which can switch to renewables and energy independence will be less susceptible to the kind of inflation shock we saw in 2022, when the price of oil soared so the name inflation reduction act is not entirely inappropriate.

Whatever, we call it the Inflation Reduction Act is the kind of investment that the UK has been reluctant and unwilling to make in recent years. The UK’s slow economic growth since 2010 was at least partly caused by austerity which held back investment in infrastructure, health care and energy independence. Furthermore, Brexit, low productivity and low growth have created a deterioration in finances, which reduces the apparent room for public investment.

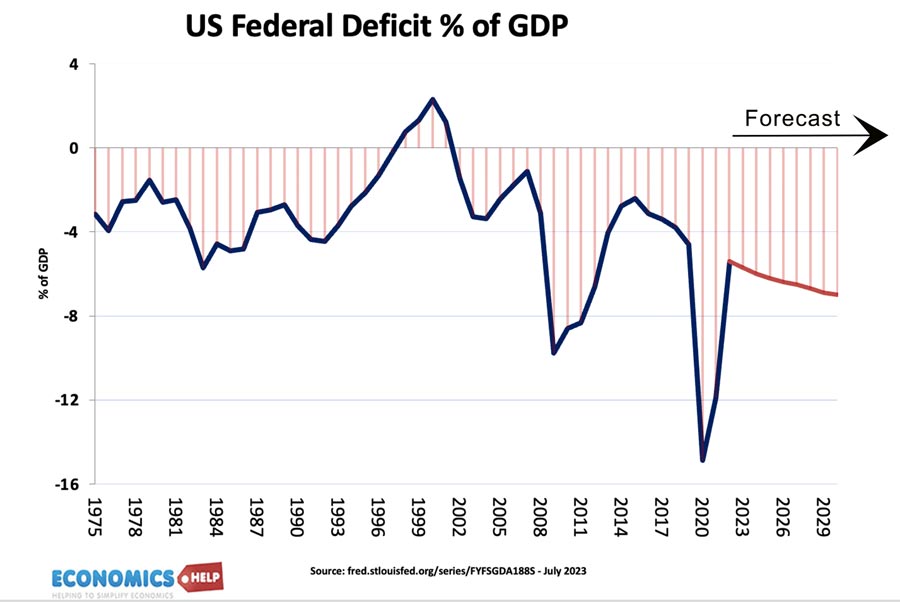

The UK mini budget of September 2022 was bold in that it was a large package of tax cuts which would have caused higher borrowing. A good question is why did markets accept the US budget deficit rising but not the UK? The US deficit is forecast to soar in the coming years. One difference is that with reasonable economic growth and falling inflation, markets are sanguine about US debt. The UK’s very poor economic growth and high inflation, makes markets much more nervous.

Strong Pound?

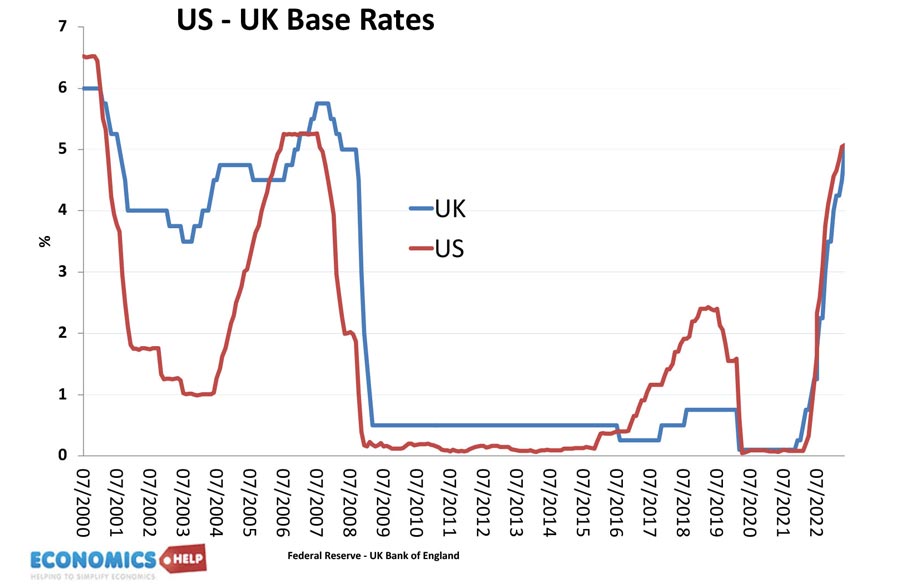

Given the contrasting performances of the economy. We might ask why has the Pound Sterling appreciated almost 15% against the dollar since last September? The reason is that firstly, the dollar was very strong for several years due to higher US growth, the rebound in the Pound, unfortunately, reflects the unexpectedly high UK inflation and the likelihood, that UK interest rates will have to rise much more than previously expected. If US inflation keeps falling, the US may only need 1 or 2 interest rates – if they are even needed at all.

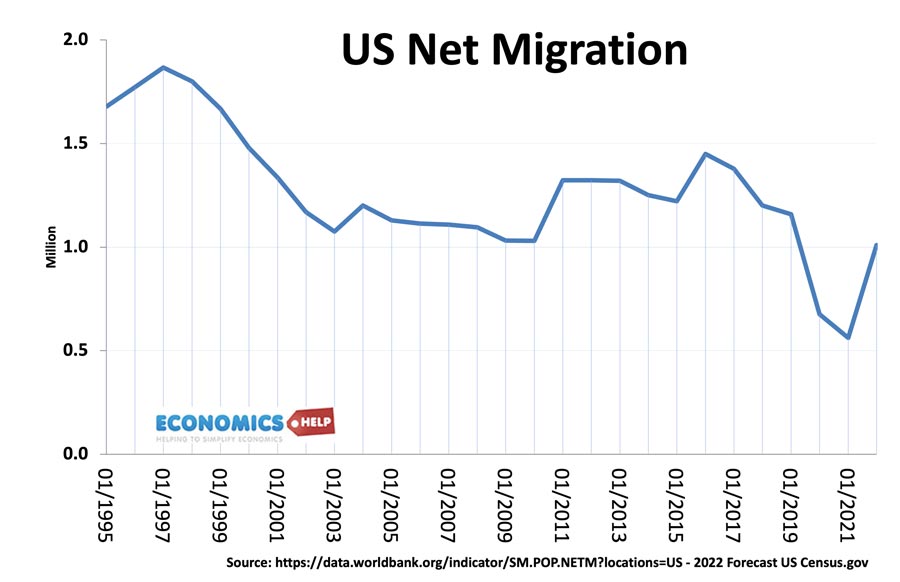

Another interesting comparison between the two countries is that the strong growth in the US has occurred despite a drop in US immigration levels. Immigration tends to promote economic growth as immigrants are of working age. High growth with low immigration and an ageing population is more admirable. Without immigration, UK growth would be even lower.

The US labour market has proved more adaptable than many imagined with a rebound in participation rates since the covid induced great resignation. For example, the number of disabled workers in the labour force has reached all time record levels. Despite the fall in inflation, unemployment has remained close to full employment, suggesting that the supposed Phillips Curve trade off is very limited when the economy is at full capacity.

Concerns over US Economy

There are two big caveats to this analysis. The first is that we should be careful of getting carried away with the strength of the US economy. So far inflation has fallen without any rise in unemployment, but higher interest rates have a lag of up to 18 months and could still bite. Like the UK, US house prices are also overvalued and rising mortgage rates will cause increasing economic pain as homeowners remortgage. If the Fed are determined to get inflation below 2%, it may cause increased problems. Also, the US political system has potentially greater volatility with highly partisan debates about raising the debt ceiling. There is always a fear of political irrationality hitting the US economy.

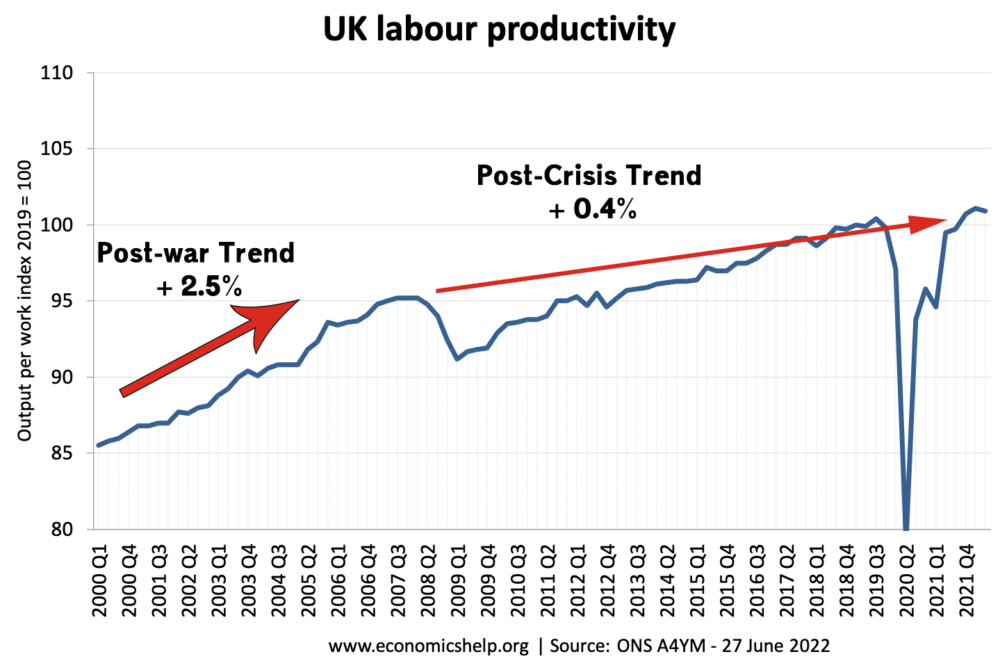

The second is that the US inflation performance does offer some hope to the UK. Usually inflation follows very closely international competitors. The drop in US inflation combined with lower energy prices means the UK should see something similar soon. But, what is more concerning for the UK economy is that the 13 years of very low growth shows no sign of ending. In recent years, there is a sense the UK economy has been desperately underperforming – wage growth is amongst the weakest in the OECD and productivity growth is similarly depressing. Both the private and public sector have been very reluctant to invest in the economy and whilst this remains the case, there are no easy short-term fixes for the UK economy. Not only that but the UK housing market is one of the most vulnerable in the world because of its high house price to income ratio. The mortgage crisis is particularly acute in the UK and this will weigh down the economy in 2023.

Also, when comparing economic performance it is important to bear in mind we are focusing on macroeconomic stats like growth and inflation, but there are many other factors behind living standards. For example, the US high level of household income also reflects the fact US workers work longer hours, with less paid holiday than European counterparts.

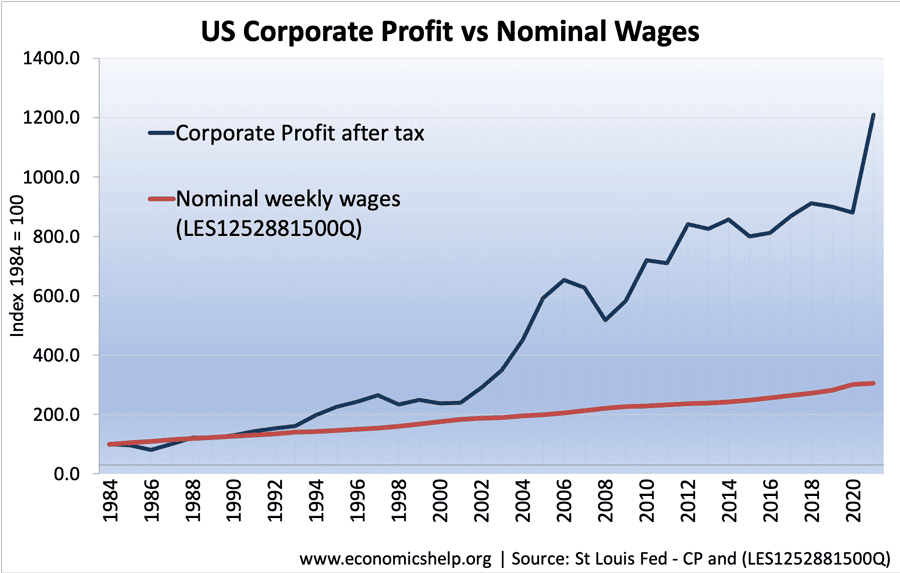

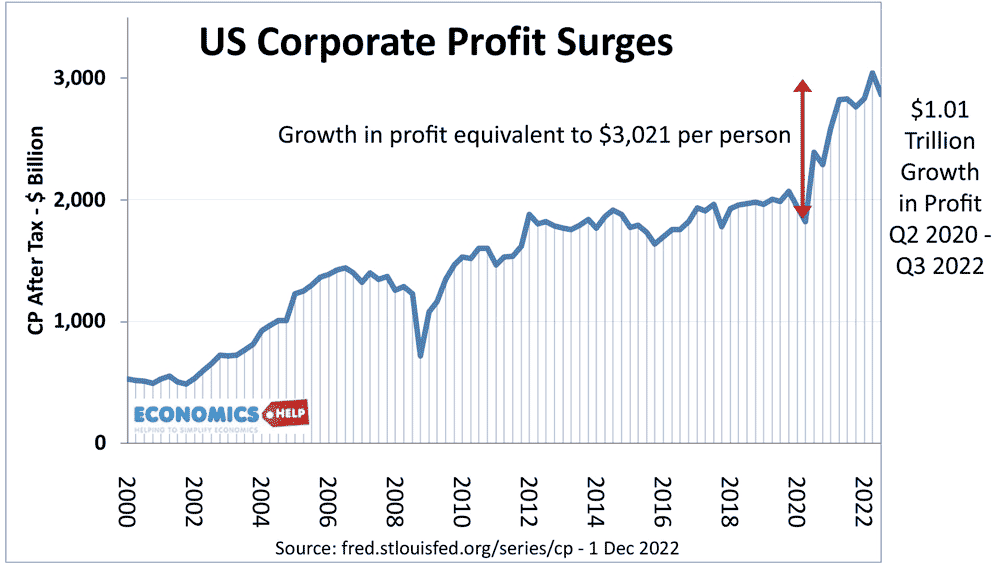

In the US GDP per capita growth has been more impressive than wage growth, with corporate profitability rising and gaining a larger share of GDP. For all the failing of the NHS in terms of underfunding, it does mean UK citizens don’t fear health bankruptcy which is all too common in the US.

However, whatever social and economic problems a country has, the state of the economy is important. Unless the UK economic performance improves underfunding of services will only continue to grow, threatening an unwelcome spiral of low growth and low investment. The US economy also shows the potential benefits of an investment in a green transition. It is expensive and has increased borrowing, but there are also long-term benefits to both the economy and less reliance on fossil fuels.

Wonderful information