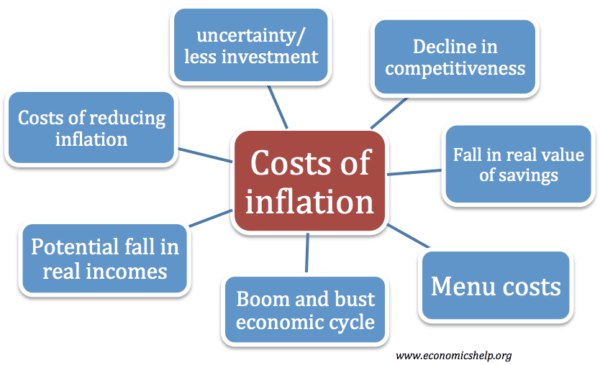

Inflation is a sustained rise in prices and increase in the cost of living. The general costs of higher inflation will be reduced purchasing power of money, fall in the value of savings, a depreciation in the exchange rate, less certainty for firms and the inconvenience of dealing with changing prices.

In addition, developing economies can be particularly susceptible to inflation because

- Higher food prices can lead to a significant rise in poverty for the low paid.

- Higher global inflation, will push up interest rates and increase the cost of debt repayments for low-income countries

- Inflation in developing economies can lead to depreciation in the exchange rate and capital outflows which can be hard to stabilise.

More detail on the impact of inflation for developing economies

1. Higher costs of living

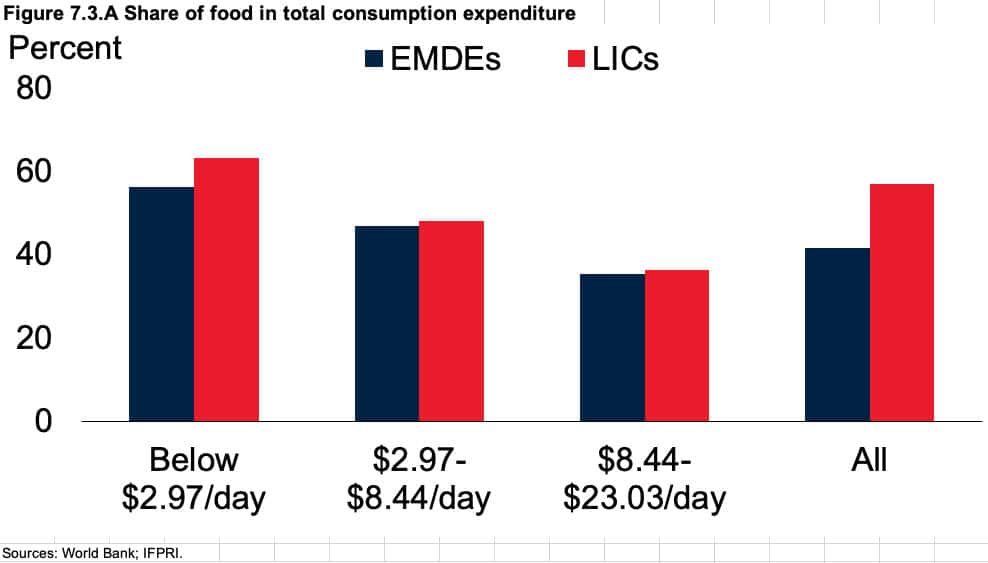

The most significant impact of inflation for developing economies is the impact on the basic cost of living. This is especially important if inflation leads to a rise in the price of basic necessities, such as food, fuel and housing. In the west, if food prices rise 10%, this may not seem so disastrous but for people on very low incomes, food prices can amount to over 70% of their total consumption, so even small changes in food prices have a big impact on their quality of life.

For example, since the COVID pandemic, Sri Lanka has faced a rise in inflation and a significant increase in the number of people below the poverty line. In 2022, Inflation in Sri Lanka was 14% in Dec 2021, and food inflation hita record 21.5%. This has caused widespread absolute poverty. Also, combined with low wage growth and falling tourism revenues, the country is struggling to pay for imports and consumers struggling to buy food. As the World Bank says

“At the microeconomic level, food price spikes are felt most severely by the poor, since they are net buyers of food and a disproportionate share of their income (two-thirds in LICs) is spent on food. Through these channels, food price spikes raise poverty, reduce nutrition, and cut the provision of essential services such as education and health care.” (World Bank 2011).

Evaluation on the cost of living

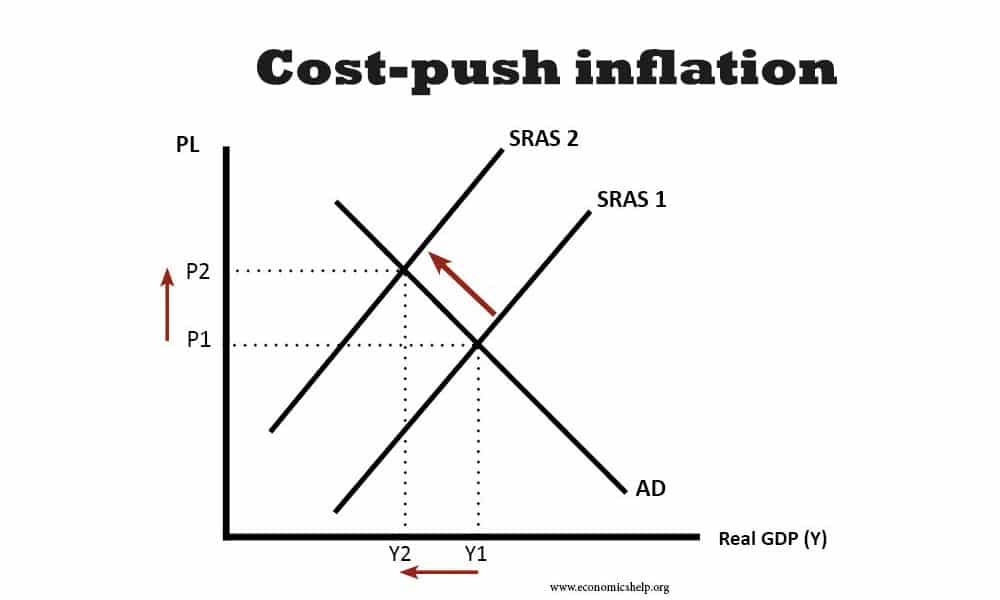

A key component is whether wages rise in line with inflation. If inflation is 14%, but wages rise 16%, then in theory, consumers can still be better off. However, if inflation outstrips wage rises, then there will be an erosion of living standards. Also, if food price inflation is higher than average inflation, then the poor are likely to be more affected. Therefore, it can depend on the type of inflation. If there is cost-push inflation, which leads to higher prices and lower output, the impact is usually more negative.

Rising cost of debt repayments

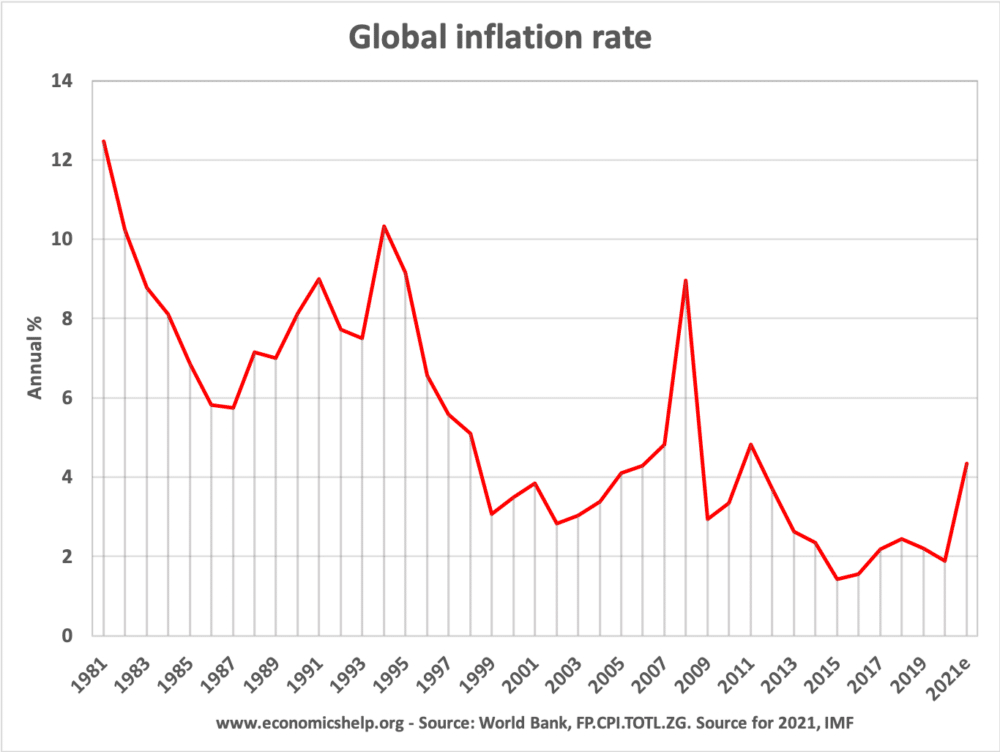

Developing countries with high external debt will face a significant cost of debt interest repayments. If there is a rise in global inflation, then we will see a rise in interest rates as Central Banks seek to cool down inflationary pressures. Higher interest rates can be particularly damaging for developing economies that face large debt interest payments. For example, in the 1970s, many Latin American countries borrowed heavily attracted by low-interest rates. However, the inflation of the late 1970s and early 1980s, led to a significant rise in interest rates as the Federal Reserve sought to reduce inflation. In 1982, several Latin American countries could no longer service their debt repayments. This led to intervention from the IMF and Latin American countries were forced to cut spending on infrastructure and welfare programmes, leading to a ‘Lost decade’ See: Latin American Debt crisis at Federal Reserve.

The concern is that in 2022, we are seeing a similar dynamic with rising interest rates due to inflation causing higher debt interest payments for low-income countries.

Devaluation

Another problem of high inflation is that developing countries are vulnerable to seeing devaluation in their exchange rate. High inflation in a developing economy makes the demand for their goods and services less attractive leading to lower demand for the exchange rate. As the exchange rate falls, it can lead to capital outflows as investors seek to protect the value of their assets. These capital outflows can, in turn, cause a further fall in confidence and more pressure on the exchange rate.

Costs of inflation

Related