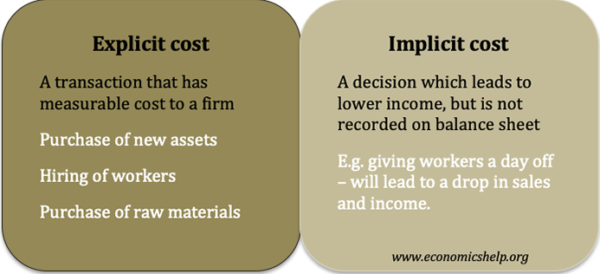

- Explicit costs involve a transfer of money and can be recorded on a balance sheet. (e.g. purchase of raw materials)

- Implicit costs are related to the opportunity cost of one course of action that leads to lower income (e.g. a shop which offers space for a charity to collect money will have lower sales) Implicit costs are not usually recorded.

Implicit costs defined

Implicit costs are the perceived or estimated loss in revenue from undertaking an action, but they do not have an actual transfer of money and are not recorded in accounting balance sheets. An example of an implicit cost is having to deal with a fire alarm, which causes a factory to shut down for two hours. There is no observable increase in costs, however by stopping production, it leads to lower output and so there is a loss of sales and income – even if it will not be recorded.

Other examples of implicit costs

- A decision not to sell an asset will lead to a depreciation in value and a loss of potential revenue from selling it.

- Spending bank reserves on investing in a project will lead to a loss of interest on the former bank savings. The cost of investing in a new factory is an explicit cost, but the loss of interest is an implicit cost.

- A business owner may take a pay cut to remain profitable. This loss of earnings for the owner is an implicit cost for business.

- A football team may decide to keep ticket prices below the market equilibrium out of a sense of loyalty to the local community. This will lead to implicit costs of lower revenue than otherwise could have been achieved.

- A firm may give a worker ‘compassionate leave’ to take time off work. This leads to a loss of output which is not directly measured.

- Failure to sell Christmas trees by 25 December. If a firm has 10 Christmas Trees unsold on 25 December, it represents a loss of potential income – there may also be time cost of disposing of trees. On Christmas eve, there may be good case to lower price to sell remaining trees. At this time, the price the firm paid in November is a sunk cost – it can’t recover this accounting cost. Sometimes firms suffer from the fallacy of sunk costs – wanting to get back the actual explicit cost, but sticking rigidly to this can lead to the implicit costs of fewer sales.

Explicit costs

An explicit costs are measurable and will be included in profit/loss accounts. For example, if the firm hires a new worker, their salary will be an explicit cost which will be put on the accounting balance sheet. The explicit cost of hiring a worker may be £20,000 a year. But, hiring a new worker may also imply some implicit costs. For example, to welcome the new worker and train him to a necessary standard may take the time of the manager, who cannot do other tasks as he trains the new workers.

Other examples of explicit costs

- Purchase of new assets, e.g. machines, factories,

- Hiring of workers – labour costs

- Purchase of raw materials

- Purchase of advertising.

All these have monetary cost and the transactions will be recorded.

Related