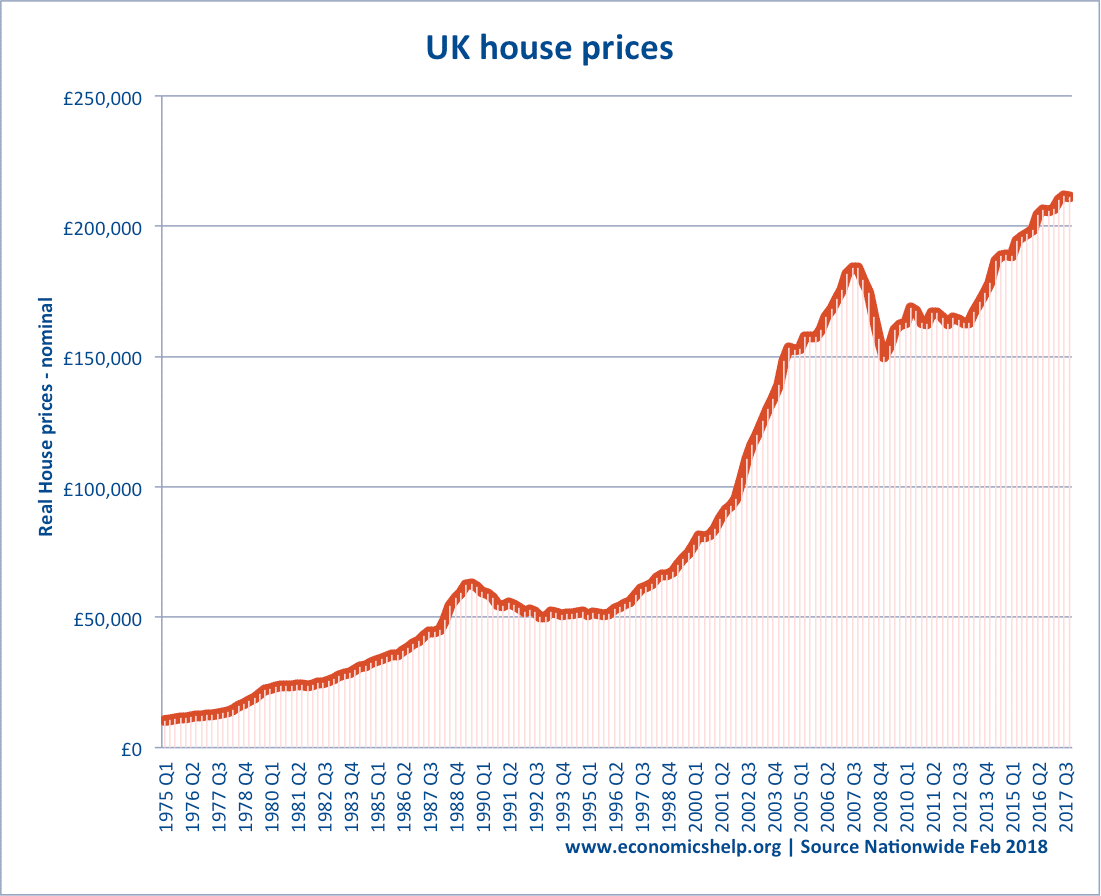

Readers Question How do you explain the long boom in house prices from the late 1990s?

There were several reasons for the long boom in house prices between 1994 and 2007.

Low Interest rates. In the early 1990s, UK interest rates reached 15% and were in double figures for several months. After the 1991 recession interest rates fell and remained low for a considerable time. With inflation seemingly under control, many expected medium term interest rates to remain low. Lower interest rates made buying a mortgage more affordable and increased the attraction of buying rather than renting.

Housing Bubble. Amongst banks, estate agents and buyers there was widespread optimism that house prices could keep rising. To a large extent this reflects a bubble psychology. see here – why we fall for bubbles

Mortgage Lending. During the long boom, house price to income ratios rose from a low of 2.5 to over 5. This meant house prices rose faster than not only inflation but also faster than real incomes. A key factor which enabled a rise in house price to incomes ratios was the development of a new range of mortgages. These new mortgages included interest only, self-certification mortgages, mortgages with low deposits and mortgages with higher income multiples.

In other words, a key factor behind the housing boom was a corresponding boom in bank lending which enabled people to borrow more. Without this development in mortgage lending, the rise in house prices would have been correspondingly higher.

Shortage of Supply

As UK house prices rose, supply of housing did not keep pace with rising demand.

There have also been plenty of other factors behind the long boom such as:

Speculation, increased buying of second homes, increased demand from abroad,

See also:

This is an interesting subject that does not consider capital flight from Russia that ammounted to tens of billions GBP into the EU/UK. For some time I had thought fincnce was the cause of the rise but there has to be another tension in the market.