A ‘no deal Brexit’ would involve a departure from the EU, the single market and the EU Customs union. Brexiteers have suggested the UK would adopt WTO rules for trade. This means, in the absence of any trade deal, it would lead to higher export tariffs and trade disruption from non-tariff barriers – the WTO makes no provision for common acceptance of regulations, licensing and trademarks. A study by BFNA suggests that in the event of a No Deal Brexit, by the year 2030, the UK economy could lose 14% of GDP or €57bn or €873 per head. There would also be costs for other EU countries – especially Ireland.

Summary of No Deal Brexit

- Higher tariffs on exports to EU and other countries

- Higher prices for consumers from import tariffs (if introduced)

- Devaluation in sterling – leading to higher prices and cost-push inflation

- Border Controls – disrupting trade and investment

- More inflexible labour market due to a fall in European workers

- Non-tariff barriers (regulations, paperwork, customs checks, different standards) increase cost for business

- Recession risk from disruption to trade, the hit to confidence and higher prices.

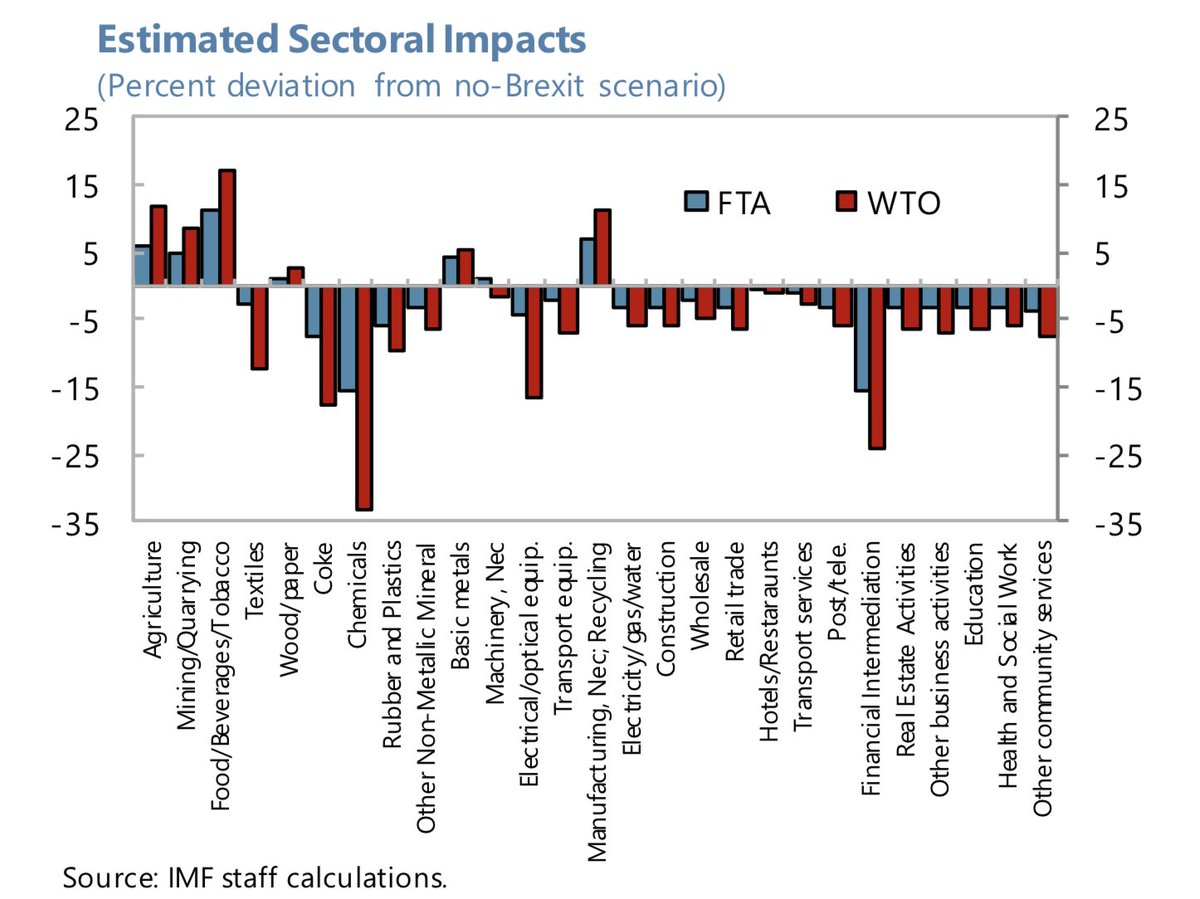

- Some sectors would benefit from different tariff rates, but others would struggle

More detail on no deal scenario.

Export tariffs. If the UK leaves without a deal, the EU will impose its standard ‘third-country’ tariffs on the UK. This means UK exporters would face average tariffs of 4.1%, but tariffs of up to 7-10% for Automobiles. In the worst case scenario as well as higher tariffs to the EU, the UK would lose its access to the EU’s 38 existing agreements (12 agreements in negotiation) with other countries. The impact of higher tariffs would be very damaging for industries, such as chemicals, mechanical engineering and automobiles. Firms would have a great incentive to relocate production to the Single Market to avoid export tariffs.

Import tariffs. Following the WTO Rules, the UK could also impose import tariffs, which would raise revenue for the government and protect domestic industries. However, this would lead to higher prices for consumers. Analysis for the GMB states it could increase price of food shopping by £15.61 a week. (17%) e.g. price hikes resulting from the application of the WTO’s “most favoured nation” rules would by 42p on a 250g pack of butter (up 28 per cent), 62p on a 460g chunk of own-brand Cheddar (up 26.9 per cent)

Brexiteers have argued it would be better for the UK if it did not impose any import tariffs – and avoid higher prices for consumers – without EU import levies, some food prices are likely to fall. However, the absence of tariffs in agriculture could cause some UK farmers to go out of business because they have got used to tariff protection in certain sectors of agriculture. Also, if we did not impose any import tariffs, it may reduce the incentive for the EU to conclude a free trade deal.

Border controls. Outside the Single market and with no effective agreement, there would need to be borders between the UK and the EU to check import of goods. Any border delays and custom checks would hit manufacturing, which relies on just-in-time management. Industries like chemicals and automobiles are deeply integrated. Cars manufactured in the UK rely on imports of parts from across the EU.

For example, BMW who manufacture the Mini in Oxford, UK point out that the crankshaft is made in France, drilled and milled in Warwickshire, and integrated into an engine in Bavaria. Any delay would make this production process more costly.

According to Academics at Imperial College, even two extra minutes spent checking each vehicle at Dover and Folkestone could lead to traffic queues of 29 miles (47 km) on nearby highways. (Imperial College blog) Border controls would be particularly contentious in Ireland, where the agriculture and business sector relies on open borders.

There is a hope that ‘technological solutions’ can enable invisible checks and borders could remain open. But, it is not clear how this could operate in practice.

Non-tariff barriers. The CBI state the additional paperwork attached to trading under WTO rules would act as an extra tariff of up to an average of 6.5%

Trademark standards. The EU has common regulation and acceptance of food standards, trademark quality and regulations of issues like certificates for pilots, licensing for truck drivers and the foreign presence of banks. These issues are not covered by the WTO rules. Without a new agreement with the EU, firms would face increased costs or damage to a brand image in creating new trademark standards. The UK government has said it will continue to accept EU trademarks for a time period (Gov.uk), but UK firms would have no right to request that EU member states take action with respect to goods suspected of infringing an Intellectual property right (Law Society on IP)

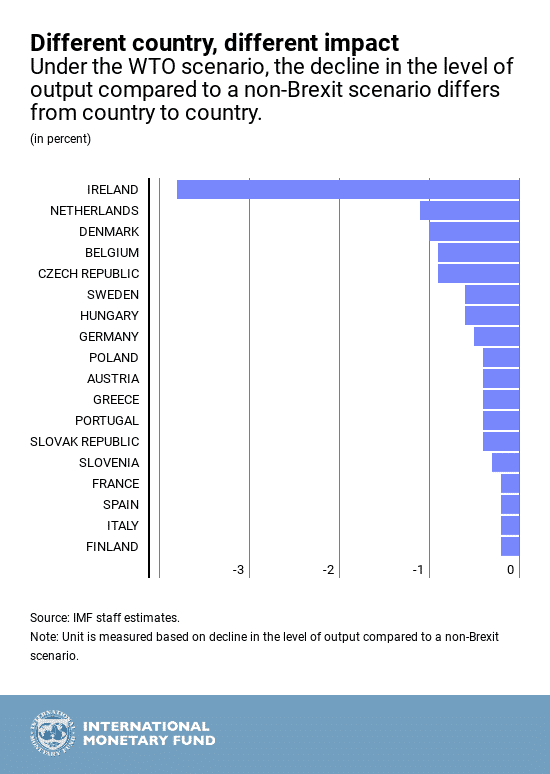

Effect on EU countries

The UK is one of the EU’s largest trading partners. 13% of EU exports go to UK. By comparison, 50% of UK exports go to the EU. The worst hit EU country by Brexit would be Ireland due to strong labour and trade integration. The IMF calculates Irish GDP would fall by 3.8%. The next worst hit would be Netherlands and Denmark at 1% of GDP (IMF Stats)

Labour market flexibility. Membership of the EU has enabled free-movement for labour to work in the EU and migrant labour from the EU to work in the UK. A no deal exit would see a decline in migrant labour. Depending on future migration policy, this could lead to labour shortages in certain areas, such as retail, agriculture sector and medical services. Net migration has been a net contributor to UK economic growth and the government budget (economic effects of immigration).

- With fewer workers, it could put upward pressure on wages in unskilled work, though the effect on wages is considered to be small. With reduced labour flows, it could also decrease pressure on the stretched housing market, for more detail see: free movement of labour

Effect on Sterling. Since the vote to leave the EU in 2016, Sterling has depreciated 10-15%. A no deal exit could see a further fall in Sterling as investors see the UK as a less attractive place to invest and save money. The Bank of England predicts Sterling could fall 10% or even more in the worst case scenario. A further depreciation in Sterling would put upward pressure on import prices and contribute to imported inflation and reduced living standards. It would also make it harder for the Bank of England to cut interest rates in the event of a downturn.

Balance of Payments. The UK runs a substantial current account deficit, which is currently financed by capital inflows. A no deal exit would make it harder to attract these capital inflows, leading to downward pressure on Sterling until the current account deficit declined.

Recession risk. Some forecasts predicted a vote to leave the EU could cause a recession. Since this recession never materialised (though UK growth slipped from the top of the G7 league table to bottom (Full Fact), forecasters have become warier. However, while a vote on its own didn’t change economic fundamentals – a no-deal Brexit changes many economic fundamentals. Not only will it affect business confidence, but there will also be real-world disruption to trade, investment and economic growth. Given the underlying weakness of the UK economy, a no-deal Brexit could precipitate an economic downturn. The https://www.ft.com/content/c7327d4a-401d-11e9-9bee-efab61506f44OECD have forecast a recession for the UK and likely spilling over into Europe in the event of a No-deal Brexit. Even if a recession doesn’t materialise, the disruption to trade will be like a ‘slow puncture’ to UK GDP reducing real output compared to potential growth inside the EU.

Opportunities from Brexit?

Brexit supporting economists such as Patrick Minford argue that a No-deal Brexit would cause short-term disruption, but in the long-term would lead to a more efficient economy with resources and jobs being reallocated into areas where we have a competitive advantage. For example, Minford argues the car industry will be run down (with 800,000 jobs related to the industry). But, he argues this will be like running down the coal industry and steel industry – new jobs will be created in the long-term.

Economies are flexible and new opportunities would develop, but to run down industries would cause significant structural unemployment and economic loss in the medium term. The 1980s saw a period of record structural unemployment – it took many years for unemployment to come down. The UK economy would eventually adjust to no-deal exit, but it could be several years for the unemployed to find new jobs, and there is no guarantee they would have the same standards of pay and conditions.

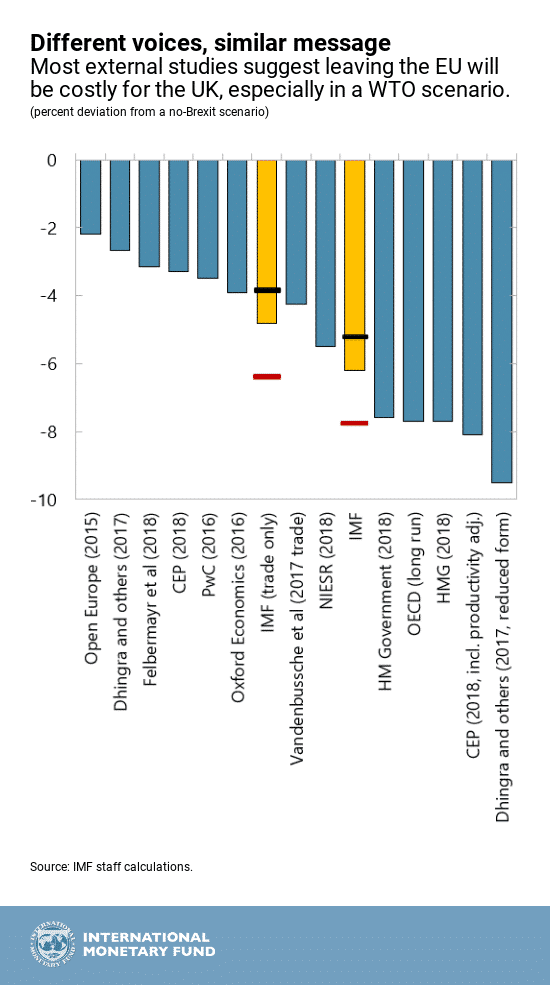

Different forecasts for UK economy under No-deal terms

Effect on GDP

..

Source: Uneven path for Brexit at IMF